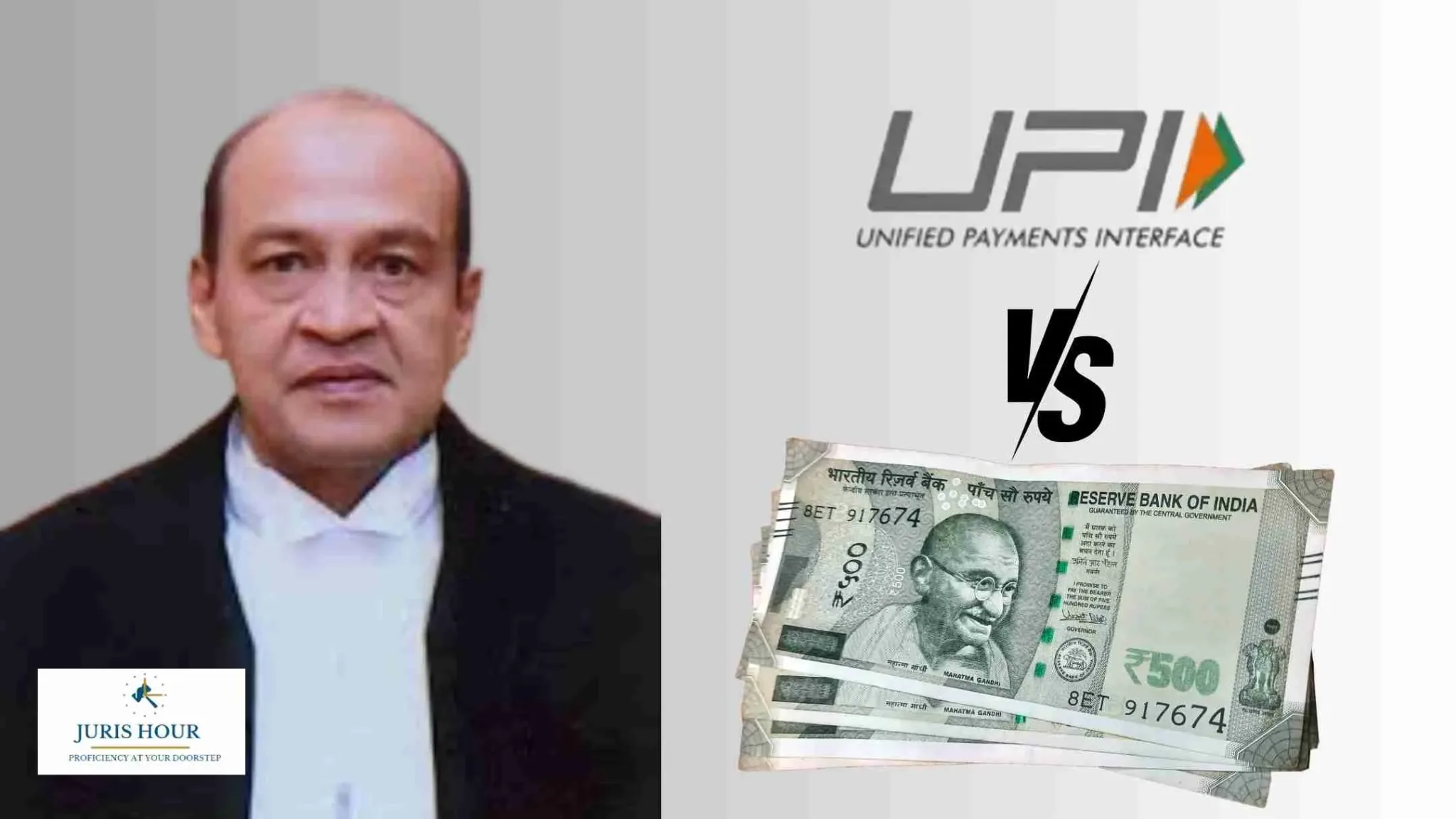

Justice Yashwant Varma, a Delhi High Court judge who once lauded India’s Unified Payments Interface (UPI) for its role in reducing cash dependency, finds himself at the center of controversy after a fire at his official residence led to the discovery of large amounts of cash.

Fire at Justice Yashwant Varma’s Residence Uncovers Cash Stash

The incident, which has raised questions about financial transparency and judicial integrity, unfolded when a fire broke out at Justice Varma’s residence while he was out of the city. His relatives promptly alerted the fire brigade, and firefighters arriving on the scene were met with an unexpected sight—heaps of cash in every room of the bungalow, as per reports.

UPI Praise vs. Cash Discovery: The Ironic Contrast

The irony was not lost on observers. Justice Varma had previously praised UPI for revolutionizing digital transactions in India. Speaking at the Indian Science Competition in 2023, hosted by Anand and Anand law firm, he stated that “UPI empowered India, leading to a revolution.” His words highlighted the government’s push for digital payments to curb black money and reliance on cash transactions.

Supreme Court’s Response and Transfer Decision

Despite his spotless professional record spanning 22 years and numerous landmark judgments, the incident has cast a shadow over his tenure. The Supreme Court Collegium, led by Chief Justice of India (CJI) Sanjiv Khanna, unanimously decided on Friday to transfer Justice Varma back to the Allahabad High Court, where he had served until October 2021. The Supreme Court, however, maintained that the transfer was unrelated to the recent revelations.

Additionally, the apex court has sought a report from the Chief Justice of the Delhi High Court on the matter, signaling further scrutiny.

Digital Payments Continue to Surge Despite Controversy

Meanwhile, the digital payments revolution Justice Varma once championed continues to thrive. The Finance Ministry reported that digital transactions surged to 18,737 crore in 2023-24 from 2,071 crore in 2017-18, marking a compounded annual growth rate (CAGR) of 44%. The total value of digital transactions also saw a substantial rise, reaching ₹3,659 lakh crore in 2023-24 from ₹1,962 lakh crore in 2017-18.

Conclusion: A Stark Reminder on Cash vs. Digital Economy

While UPI remains a testament to India’s fintech prowess, some transactions, it appears, still elude the digital ecosystem. And for Justice Varma, his past praise for the system has not aged well in light of the unfolding controversy.

Read More: Rs. 108 Crore GST Evasion: Madras High Court Grants Bail Subject To Rs. 5 Lakh Bond

- Whether Wrong Address & GSTIN on Invoices Should Deny ITC? Supreme Court Admits Dept’s Appeal - July 15, 2025

- ICAI vs BCI: Which Is Stricter? - July 15, 2025

- Foreigners Subject to Dual Tax Regime Under Singapore’s Income Tax Laws - July 15, 2025

![Anant Ambani’s Rs. 5,000 Crore Wedding Half-Sponsored By BSNL’s Rs. 1,944.92 Crore Loss with Reliance Jio, Reveals CAG Report [READ REPORT]](https://www.jurishour.in/wp-content/uploads/2025/04/CAG-report.webp)