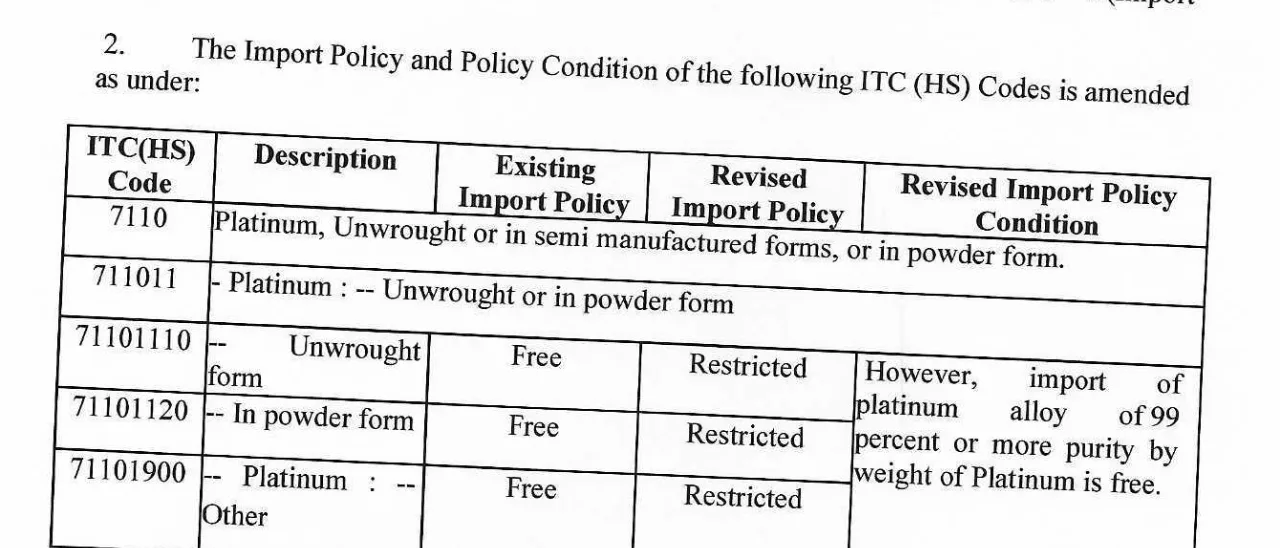

The Directorate General of Foreign Trade (DGFT) has revised the Import Policy of Platinum covered under ITC (HS) 71101110, 71101120 and 71101900 from “Free” to “Restricted” except for platinum alloy of 99% or more purity by weight of Platinum.

In a significant update to India’s import regulations, the government has amended the import policy for platinum under ITC(HS) Code 7110. The revised policy now imposes restrictions on the import of unwrought and powdered platinum while allowing free import of platinum alloy with a purity of 99 percent or more.

Previously, the import policy allowed unrestricted import of unwrought and powdered platinum under subcategories 71101110 and 71101120. However, under the revised policy, these imports are now categorized as “Restricted,” requiring additional permissions. Similarly, under ITC(HS) Code 71101900 (Platinum – Other), the import policy has also been changed from “Free” to “Restricted.”

The new policy aims to regulate the import of platinum and ensure better control over its trade. However, the import of platinum alloy with 99% or more purity remains unrestricted.

This amendment is expected to impact businesses dealing with platinum imports, requiring them to comply with additional regulatory procedures. The government’s move is seen as a step towards monitoring and regulating precious metal imports more effectively.

Notification Details

Notification No. 60/2024-25

Date: 05/03/2025