The Goods and Services Tax Network (GSTN) has operationalised a new online facility titled “Application for Unbarring Returns” on the GST portal, offering registered taxpayers a formal mechanism to seek unblocking of GST returns that have been system-barred due to prolonged non-compliance.

Under Rule 59(6) of the CGST Rules, read with Sections 39 and 47 of the CGST Act, the GST system automatically bars the filing of returns where a registered person fails to furnish returns for a continuous period of three years. Once this system-level barring is triggered, the relevant return period becomes non-editable, and the taxpayer is technically prevented from filing the pending return, effectively halting further compliance.

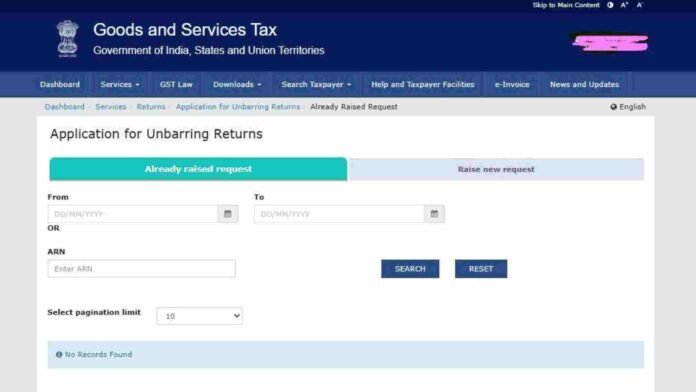

To address this issue, GSTN has now enabled an online application process allowing taxpayers to seek relief. The application can be filed through the GST portal by navigating to Services → Returns → Application for Unbarring Returns. This move is expected to streamline the process and reduce dependency on manual representations or offline follow-ups with tax authorities.

As part of the application, taxpayers are required to clearly state the reasons for non-filing of returns for the barred period. The application is then electronically routed to the Jurisdictional Assessing Officer (AO) for examination. This ensures that the request is evaluated by the competent authority having jurisdiction over the taxpayer.

Upon being satisfied with the reasons provided and the overall compliance position, the Assessing Officer may approve the application for unbarring. Once approved, the GST system automatically makes the previously barred return available for filing, enabling the taxpayer to regularise past non-compliance.

Read More: Assessment Order Invalid if Passed by Officer Lacking Pecuniary Jurisdiction: ITAT