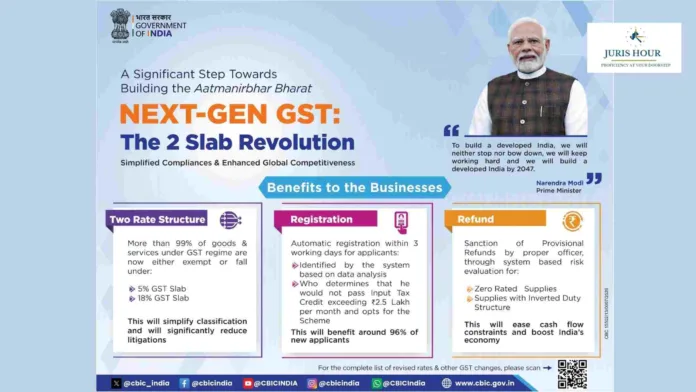

New Delhi: In a major reform aimed at simplifying India’s tax regime and enhancing global competitiveness, the Government of India has announced the launch of Next-Gen GST, popularly termed as the “2 Slab Revolution.” The reform introduces a streamlined GST structure with only two tax slabs—5% and 18%—covering over 99% of goods and services, while keeping certain items exempt.

The move is being hailed as a significant step towards building an Aatmanirbhar Bharat, with promises of easier compliance, reduced litigation, and a major boost to businesses across sectors.

Two Rate Structure

Under the new framework, most goods and services will either be exempt or taxed at 5% or 18%. This rationalization is expected to eliminate complexities in classification and significantly reduce disputes between taxpayers and authorities. According to government estimates, more than 99% of taxable items now fall under this simplified structure.

Faster Registration Process

Another key feature of the reform is the automatic registration system. New applicants will now be registered within three working days through a system-driven process based on data analysis. The system will automatically identify applicants and allow registration provided they are not flagged for high input tax credit risks.

This is expected to benefit nearly 96% of new applicants, ensuring smoother entry into the GST framework and reducing bureaucratic delays.

Refund Reforms

The government has also announced faster provisional refunds to ease liquidity pressures on businesses. Refunds for zero-rated supplies and supplies under the inverted duty structure will be sanctioned by a proper officer based on system-driven risk evaluation.

This initiative aims to ease cash flow constraints and boost India’s economy by ensuring that genuine taxpayers receive timely refunds without procedural bottlenecks.

Prime Minister’s Vision

Commenting on the reform, Prime Minister Narendra Modi reiterated his government’s commitment to making India a developed nation by 2047. He stated:

“To build a developed India, we will neither stop nor bow down, we will keep working hard and we will build a developed India by 2047.”

Industry Response

Industry experts have welcomed the reform, noting that the two-slab system will reduce compliance costs and make India’s taxation system more business-friendly. Economists believe the simplified structure will help attract foreign investment and enhance India’s standing in the Ease of Doing Business index.

Looking Ahead

The government has indicated that further steps may be taken to rationalize exemptions and improve the IT infrastructure of GST. With this reform, policymakers expect a new era of tax compliance that balances simplicity, efficiency, and economic growth.