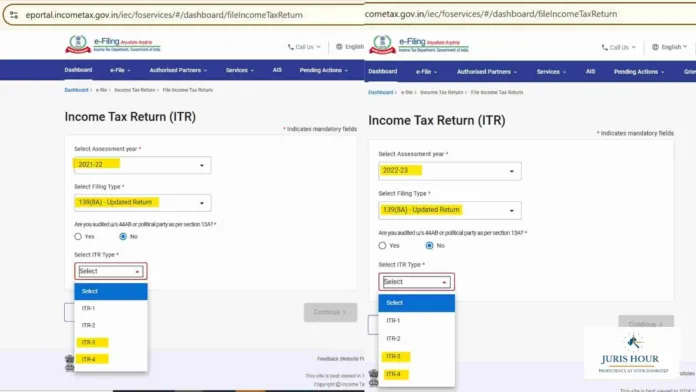

In a significant update for taxpayers, the Income Tax Department has announced that the facility to file Updated Returns under Section 139(8A) of the Income Tax Act is now available for Assessment Years (AY) 2021-22 and AY 2022-23 for ITR-3 and ITR-4 forms.

The announcement, shared via official communication, clarifies that individuals who need to correct or update their earlier filed returns for the specified years can now access this feature through the Income Tax e-filing portal: incometax.gov.in/iec/foportal.

Key Highlights of the Update

- Applicable Years: AY 2021-22 and AY 2022-23.

- Available ITR Forms: ITR-3 (for individuals and HUFs having income from profits and gains of business or profession) and ITR-4 (for individuals, HUFs, and firms opting for presumptive taxation under Sections 44AD, 44ADA, and 44AE).

- Filing Type: Updated Returns under Section 139(8A), which allows taxpayers to correct omissions, mistakes, or missed reporting of income in previously filed returns.

- Exclusion Check: Taxpayers will have to confirm if they are covered under Sections 44AB or political party provisions under Section 13A before proceeding.

Purpose of Section 139(8A)

Section 139(8A) was introduced to give taxpayers a final chance to declare any additional income or rectify errors in their original or belated ITRs, with the aim of improving compliance and reducing litigation. However, such updated returns may attract additional tax liability, including interest and penalty, depending on the time of filing and the nature of the omission.

Steps to Access the Facility

- Log in to the Income Tax e-filing portal.

- Select the relevant Assessment Year (2021-22 or 2022-23).

- Choose the filing type as “139(8A) – Updated Return”.

- Select the applicable ITR form (ITR-3 or ITR-4).

- Fill in the updated details and proceed to file.

Why This Matters

Tax experts note that this facility is particularly useful for small business owners, professionals, and taxpayers under the presumptive taxation scheme who may have inadvertently omitted income or claimed incorrect deductions. By enabling updated returns for past years, the Income Tax Department is giving an opportunity to regularize compliance before the cases are flagged during scrutiny or faceless assessment proceedings.

The facility is live now, and taxpayers are advised to act promptly as the statutory window for filing updated returns is time-bound.

Read More: GST Act Bars Second Provisional Attachment After One-Year Limit: Supreme Court