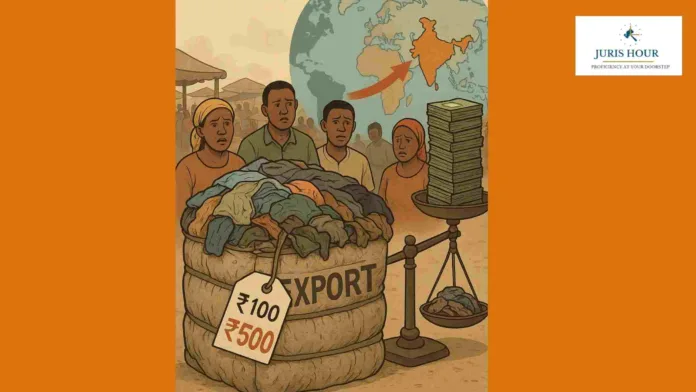

The Directorate of Revenue Intelligence (DRI) has unearthed a massive export incentive fraud worth nearly ₹115 crore, exposing a syndicate that manipulated export schemes by showing inflated shipments of inferior-quality garments.

According to DRI officials, the racket involved exporting low-grade garments to African countries, with their values inflated by nearly five to six times the actual market price. The fraudulent operations enabled the syndicate to unlawfully claim tax benefits amounting to around ₹114.74 crore.

Mastermind and Customs Broker Arrested

Acting on specific intelligence inputs, DRI intercepted two consignments at the Inland Container Depot (ICD) in Talegaon, Pune. The seizures led to the arrest of the Mumbai-based mastermind behind the fraud. A Customs broker, who allegedly facilitated the scam in exchange for commissions, was also taken into custody.

Use of Dummy Importer-Exporter Codes

Investigations revealed that the group fraudulently claimed benefits under the Drawback and Rebate of State and Central Levies and Taxes (RoSCTL) schemes. They did so by mis-declaring low-value garments as high-value exports, using multiple fictitious Importer-Exporter Codes (IECs) issued in the names of non-existent individuals.

“Examination of seized consignments confirmed that poor-quality goods were being exported at grossly exaggerated values. Simultaneous searches across eight premises in Mumbai yielded incriminating evidence, including fake invoices,” a senior DRI official confirmed.

Digital Evidence and Modus Operandi

The syndicate’s documentation and invoices were fabricated by the arrested mastermind. During searches, DRI officers recovered crucial digital evidence establishing the creation of fake invoices and other fraudulent paperwork.

In his voluntary statement, the accused admitted that the group sourced cheap, low-quality garments from local markets in Mumbai, Kolkata, and other cities without proper invoices or e-way bills. These goods were then exported after being deliberately overvalued.

Using this method, the syndicate illegally availed a drawback of approximately ₹18.74 crore, along with RoSCTL benefits worth nearly ₹96 crore.

Wider Implications

Preliminary investigations indicate that at least 14 fictitious IECs were used in this fraud. Authorities suspect a larger network may be involved, and further probe is underway.

Officials said the case highlights growing misuse of government incentive schemes, emphasizing the need for stricter monitoring of export documentation and IEC issuance.

Read More: Delhi Govt Hikes Remuneration of Delhi High Court Law Researchers to ₹80,000