A taxpayer’s application for a routine GST amendment has remained “Pending for Validation” for over 50 days on the GSTN portal, raising serious concerns over the digital infrastructure and responsiveness of the Goods and Services Tax Network (GSTN) managed by Infosys.

The Issue at Hand

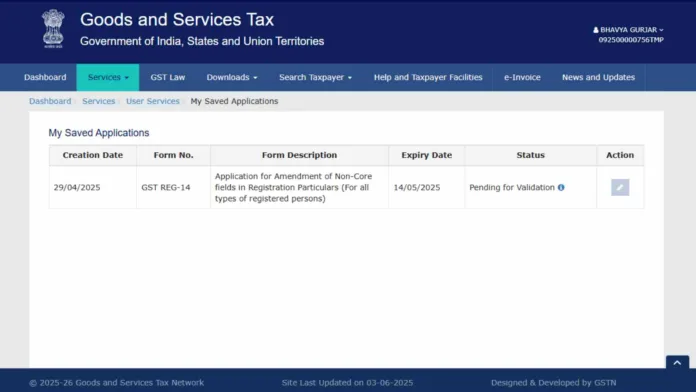

On April 29, 2025, Bhavya Gurjar filed GST REG-14 for a Non-Core amendment in registration particulars through the official GST portal. Despite providing all necessary documentation and repeatedly following up, the application continues to show “Pending for Validation” as of June 18, 2025.

A helpdesk ticket (G-202505021809655) was raised promptly with Infosys, the IT service provider for GSTN. However, multiple follow-ups and resubmissions of supporting documents have reportedly gone unanswered or unresolved.

Frustration and Escalation

Gurjar expressed frustration on social media, tagging Finance Minister Nirmala Sitharaman, Prime Minister Narendra Modi, @cbic_india, and @FinMinIndia. “Despite giving all details to @Infosys_GSTN, my application is still not validated. What should I do to get my Non-Core amendment approved?” reads one of the posts.

What are Non-Core Amendments?

Non-Core fields include changes such as updating contact information, bank details, or authorized signatories—amendments that do not affect the basic constitution of the business. These are expected to be processed without physical verification or undue delay.

Broader Implications

This incident underscores the challenges many taxpayers face with the digital GST system, despite years of operation and significant public funds invested in its development. The GST Council and CBIC have long advocated digital compliance and ease of doing business, but such technical bottlenecks risk undermining trust.

Call for Accountability

Tax professionals are now urging the Ministry of Finance and the GST Council to intervene and streamline the back-end validation process, especially for non-core amendments which are supposed to be non-disruptive.

Unless addressed swiftly, this delay may set a concerning precedent for the responsiveness of the GST system to genuine taxpayer grievances.

Read More: Justice Yashwant Varma Refuses to Resign, Citing ‘Unjust’ Process in Misconduct Probe