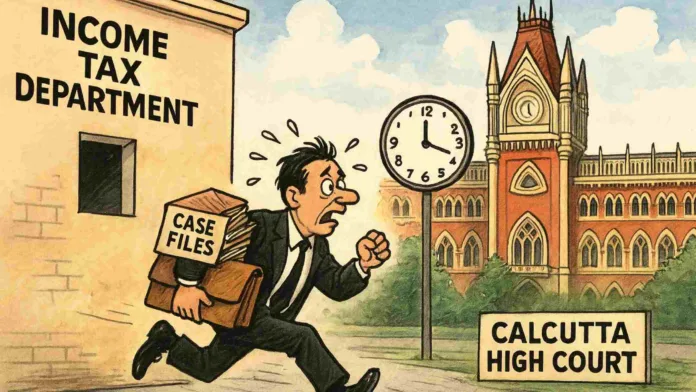

The Calcutta High Court has come down sharply on the Income Tax Department for failing to clear outstanding fee and expense bills of its Advocate (standing counsel), even as it dismissed a department’s appeal due to an “inordinate and unexplained” delay of 657 days in filing.

The Bench of Chief Justice T.S. Sivagnanam and Justice Chaitali Chatterjee (Das) noted that the issue of unpaid lawyers’ fees had caused repeated adjournments in the matter. The Court made it clear that timely payment to counsel was crucial for the Department’s ability to defend its cases effectively.

The dispute stems from an order passed by the Income Tax Appellate Tribunal (ITAT), Kolkata ‘C’ Bench, on March 10, 2021, in favour of M/s Shivam Dhatu Udyog Ltd. for the assessment year 2012–13. The ITAT ruling went against the Revenue, prompting the Principal Commissioner of Income Tax-1, Kolkata, to consider a challenge before the High Court under Section 260A of the Income Tax Act, 1961.

According to court records, the Department received the ITAT order on July 6, 2021. However, the appeal was not lodged with the High Court until August 22, 2023 — more than two years later. After deducting the statutory 120-day period permitted for filing such appeals, the delay was calculated at 657 days.

The Department sought condonation of the delay through an application (GA/1/2023), claiming that the delay occurred because files were “moving from one table to another” and due to changes in the officers handling the case. The affidavit did not cite any extraordinary circumstances such as legal complexity, unavoidable administrative barriers, or force majeure events.

Unpaid lawyers’ fees flagged

Before ruling on the appeal, the Court noted that the matter had been kept pending for some time due to the non-payment of dues to the Department’s standing counsel. Periodic reports had been filed in this regard, including one dated July 31, 2025, from the Commissioner of Income Tax (Judicial) to the High Court’s Registrar General.

The court observed that some of the lawyers awaiting payment were no longer on the Department’s panel, warning that continued non-settlement of bills would hinder the Department’s ability to secure representation. “The appropriate authority should ensure that the fee bills and expense claims of learned counsel are not kept pending and are settled on a periodic basis,” the Court said, expressing the “hope and wish” that the matter would be taken seriously.

While the appeal was dismissed on procedural grounds, the substantial questions of law raised by the department were left open for consideration in a future case.

Case Details

Case Title: Principal Commissioner Of Income Tax-1, Kolkata Vs M/S. Shivam Dhatu Udyog Ltd., Kolkata

Case No.: ITAT/205/2023 IA NO: GA/1/2023, GA/2/2023

Date: 5th August, 2025

Counsel For Petitioner: Smarajit Roychowdhury, Adv.

Counsel For Respondent: Avra Mazumder, Adv.

Read More: Time-Barred Reassessment Notice in MCX Trading Case Quashed: Calcutta High Court