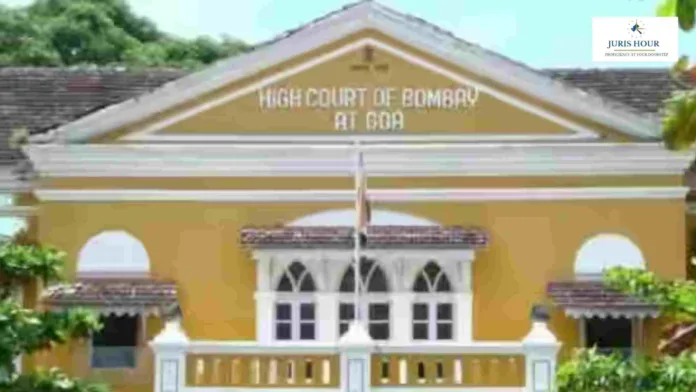

The Bombay High Court at Goa has held that the Income Tax Appellate Tribunal (ITAT) must serve orders on assessee, not just Chartered Accountant (CA) acting as Authorised Representative (AR) without specific authorisation.

The bench of Justice Bharati Dangre and Justice Nivedita P. Mehta has observed that in absence of express authorisation to the lawyer to receive the order, it was held that it cannot be taken as a starting point for limitation.

The Applicant along with her husband, were assessed to tax for the Assessment Year 2009-2010 and they having filed the Appeals before the Commissioner of Income Tax (Appeals), their appeals came to be allowed. This gave a cause for the department to approach the ITAT by filing Income Tax Appeal.

The Income Tax Appellate Tribunal heard the Appeals of the department, where the Assessees were represented by Sandeep Bhandare, a Chartered Accountant, and the departmental representative represented the Revenue.

It is pertinent to note that Ajit Phatarpekar passed away on 02.04.2016, which is during the pendency of the Appeals and when the decision was pronounced by the Appellate Tribunal on 14.09.2016, in fact it was only the assessee, Neelam Phatarpekar against whom the order was passed and the Appeals filed by the Revenue were allowed, with the finding being recorded that the Tribunal which has held that the Appeal is not maintainable against the order passed by the Assessing Officer giving effect to the order passed under Section 263 by the Commissioner of Income Tax, cannot be sustained.

The applicant contended that the impugned order was passed but the Applicant was not aware of the said order until April 2024 when she was served with a recovery notice for the Assessment Year 2009-2010 and thereafter she applied for certified copy of the order, which was received by her on 17.04.2024 and therefore the delay of 40 days has occasioned in filing the appeal, if counted from the date of receipt of the certified copy of the order.

The department contended that communication of the order passed by ITAT, Panaji, to the Chartered Accountant who was representing the assessee in the proceedings before the Tribunal is akin to the communication to the assessee, i.e. the Applicant.

The issue raised was whether the copy of the order passed by the Tribunal when served upon the Chartered Accountant is sufficient service and whether it can be construed as ‘copy received by the assessee/applicant’.

The court held that the Chartered Accountant since is not also authorised specifically to accept a copy of the order, cannot be said to be a recognised agent of the Assessee.

Case Details

Case Title: Mrs. Neelam Ajit Phatarpekar Versus The Assistant Commissioner of Income Tax

Case No.: Miscellaneous Civil Application No.491 And 492 Of 2024

Date: 23rd JUNE, 2025

Counsel For Applicant: Mr Dharan Gandhi, Advocate with Mr Gaurang Panandiker, Advocate

Counsel For Respondent: Ms Susan Linhares, Senior Standing Counsel with Ms Swati Wagh Kamat, Standing Counsel

Read More: Trump Slaps 50% Tariff on India Over Russian Oil Imports