The Central Board of Direct Taxes (CBDT), through the Draft Income-tax Rules, 2026, has proposed a significant compliance change for taxpayers claiming Foreign Tax Credit (FTC). As per the proposed Draft Rule 76, Form 44, which is prescribed for claiming FTC, will now require mandatory verification by CA (Chartered Accountant) in specified cases.

When CA Verification Becomes Mandatory

Under the draft rules, Form 44 must be verified by an accountant in the following situations:

- Where the assessee is a company, irrespective of the amount of foreign tax paid; or

- In non-company cases, where the foreign tax paid outside India is ₹1 lakh or more.

This marks a departure from the earlier regime, where self-certification along with supporting documents was generally sufficient in many cases.

Scope of Accountant’s Certification

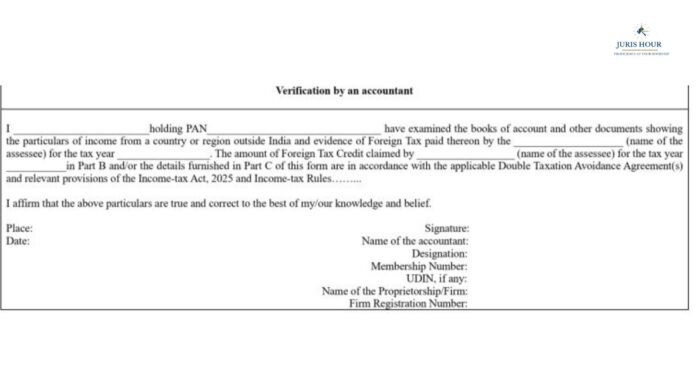

The draft rules clearly lay down the scope of verification to be carried out by the accountant. The accountant will be required to certify:

- Income earned outside India, along with verification of relevant books of account and supporting documents;

- Evidence of payment of foreign tax, including tax challans or withholding tax certificates;

- Correctness of the Foreign Tax Credit claimed, ensuring it is in accordance with the applicable Double Taxation Avoidance Agreement (DTAA) and the provisions of the Income-tax Act, 2025.

The certification format appended to the draft rules requires the accountant to confirm that the particulars furnished in Part B and Part C of Form 44 are accurate and compliant with law.

Increased Compliance and Due Diligence

The proposed requirement signals a move towards stricter scrutiny of FTC claims, particularly in cross-border income cases involving high-value foreign tax payments. By shifting responsibility onto professional verification, the tax administration aims to reduce errors, inflated claims, and disputes during assessment.

For taxpayers, especially individuals with overseas income and multinational companies, this change will mean additional compliance costs and documentation, but may also bring greater certainty during assessments.

Next Steps

As these are draft rules, stakeholders have an opportunity to submit feedback before finalisation. Once notified, the new verification requirement is expected to apply from the assessment year notified under the Income-tax Act, 2025.

Taxpayers claiming foreign tax credit are advised to start aligning documentation and processes in anticipation of the final rules, particularly where foreign tax payments are substantial.