The Goods and Services Tax Network (GSTN) has merged the earlier “additional notices & orders” tab with the main “notices and orders” section on the GST portal.

In a significant usability enhancement aimed at improving transparency and taxpayer compliance, the Goods and Services Tax Network (GSTN) has introduced a dedicated “Notices and Orders” tab directly on the GST portal dashboard.

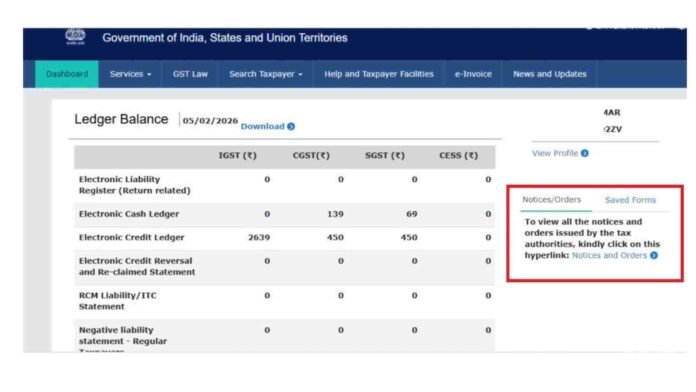

The new feature is now prominently visible to taxpayers upon logging into the GST portal, allowing them to easily access all notices and orders issued by tax authorities without navigating through multiple menus.

Consolidation of Notices for Easier Access

As part of this update, GSTN has merged the earlier “Additional Notices & Orders” tab with the main “Notices and Orders” section. This consolidation ensures that all communications—whether issued during assessment, audit, scrutiny, or enforcement proceedings—are available at a single, unified location.

The move addresses long-standing concerns raised by taxpayers and professionals regarding missed notices due to fragmented display across different tabs.

Key Features of the Update

- A clearly visible “Notices and Orders” tab on the GST dashboard

- Single-window access to all notices and orders issued by tax authorities

- Elimination of confusion caused by multiple notice sections

- Improved compliance by reducing the risk of missed statutory communications

Judicial Pronouncements on Additional Notices & Orders tab In GST Portal

The GSTN’s decision to consolidate the “Additional Notices & Orders” tab into the main “Notices and Orders” section follows extensive litigation across High Courts, where taxpayers challenged the validity of notices uploaded exclusively under the “Additional Notices” tab of the GST portal. Several writ petitions were filed contending that such uploads, without proper alert or visibility, violated principles of natural justice.

Favour of Assessee

- Delhi High Court Quashes Show Cause Notice, Order Which Were Uploaded On GST Portal Under “View Additional Notice Tab”

- Mere Uploading Notices On GST Portal Under ‘additional Notices And Orders’ Doesn’t Constitute Valid Service: Patna High Court