You Searched For "GSTN"

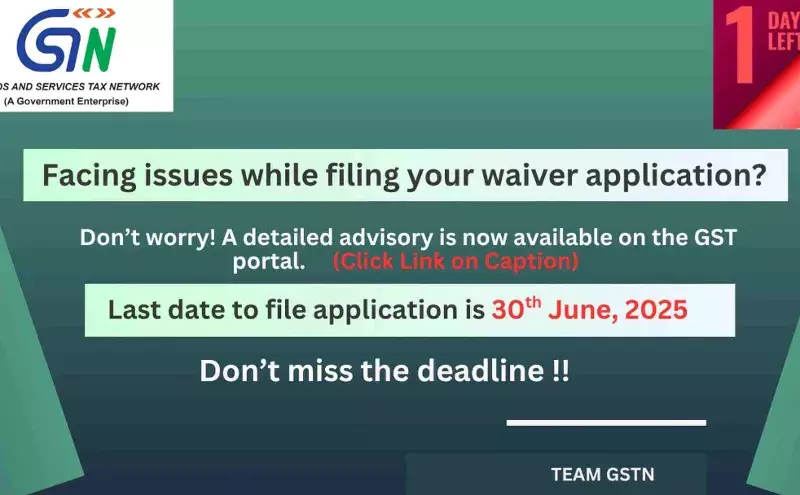

1 Day Left: GSTN Issues Reminder To File Waiver Application

The Goods and Services Tax Network (GSTN), the government’s IT backbone for GST operations, has issued a final reminder...

QRMP Taxpayers Can Now File Refund Applications on GST Portal: GSTN

The Goods and Service Tax Network (GSTN) has issued the advisory on system validation for filing of refund applications...

Refund Filing Process For Various Categories Notified: GSTN

The Goods and Service Tax Network (GSTN) has made important changes in the refund filing process in various categories. ...

GSTN to Mandate Phase-3 HSN Code Reporting and Table 13 Compliance...

In a continued effort to enhance transparency and streamline tax reporting, the Goods and Services Tax Network (GSTN)...

GSTN Issues Advisory On Case Sensitivity in IRN Generation

The Goods and service Tax Network has issued the advisory on case sensitivity in Invoice Reporting Portal (IRN)...

Taxpayers Can File Waiver Application Until June 30, 2025: GSTN

The Goods and Service Tax Network (GSTN) has notified that the waiver application (SPL 01/SPL 02) deadline until June...

GSTN Issues Advisory For Biometric-Based Aadhaar Authentication,...

The Goods and Service Tax Network (GSTN) has issued the advisory for biometric-based aadhaar authentication and document...

Now Can Directors To Opt for Biometric Authentication In Home State:...

The Goods and Service Tax Network (GSTN) has issued the advisory in respect of enhancements in Biometric Functionality,...

E-Way Bill Generation Withdrawn On Precious Metals, Stones &...

The Goods and Service Tax Network has issued the advisory on on e-way bill generation for goods under chapter 71 which...

New Option For Generating E-Way Bills For Gold Introduced In Kerala...

The Goods and Service Tax Network (GSTN) has issued the advisory on the Introduction of E-Way Bill (EWB) for Gold in...

GSTN To Implement 3rd Phase Of Mandatory Mentioning Of HSN codes In...

The Goods and Service Tax Network (GSTN) has been notified to implement the 3rd phase of mandatory mentioning of...

GSTN Notifies Generation Date For Draft GSTR 2B For December 2024

The Goods and Service tax Network (GSTN) notified the generation date for draft GSTR 2B for December 2024. In light...