The Income Tax Department has begun sending urgent electronic communications to taxpayers, warning them to revise their Income Tax Returns (ITRs) for Assessment Year 2025–26 if they have foreign assets or foreign income that were not disclosed in the originally filed return.

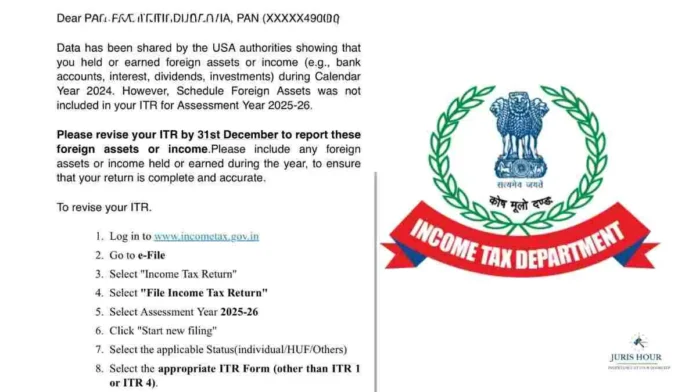

According to the emails issued by the Department, information has been received from United States authorities indicating that certain taxpayers held or earned income from foreign assets such as overseas bank accounts, interest, dividends, or investments during Calendar Year 2024. However, the corresponding Schedule Foreign Assets (Schedule FA) was found missing in their ITR filings.

Data Sharing Under International Tax Cooperation

The communication highlights that the information has been shared under international tax information exchange frameworks, including automatic exchange of financial account information. Such data-sharing mechanisms enable tax authorities to receive details of overseas financial holdings of Indian residents from foreign jurisdictions, especially countries like the US.

The Department has clarified that while the return may have been filed, non-reporting of foreign assets or income renders the return incomplete and inaccurate under the Income-tax Act.

December 31 Deadline to Revise Returns

Taxpayers receiving the alert have been directed to revise their ITR on or before December 31, 2025, by selecting the relevant assessment year and filing a fresh return with complete disclosure of foreign assets and income.

The email outlines a step-by-step process on the income tax e-filing portal, including selecting an appropriate ITR form other than ITR-1 or ITR-4, as these simplified forms do not permit foreign asset disclosure.

Heavy Penalties Under the Black Money Act

The advisory carries a strong warning on the consequences of non-compliance. Under the Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015, failure to disclose foreign assets can attract a penalty of ₹10 lakh, even if no tax is payable on such assets.

However, recent relaxations provide limited relief. No penalty will be levied if the aggregate value of undisclosed foreign assets (excluding immovable property) does not exceed ₹20 lakh. This threshold-based relief applies only to certain movable assets and does not extend to overseas real estate holdings

Who Needs to Act Immediately

Tax experts advise that resident taxpayers, including salaried individuals, professionals, and investors, should urgently review whether they had:

- Overseas bank accounts (including dormant accounts),

- Foreign shareholdings or mutual funds,

- Foreign brokerage or investment accounts,

- Dividend, interest, or capital gains income earned abroad.

Even assets that generate nil or exempt income are required to be disclosed in Schedule FA if held during the year.

Compliance Opportunity Before Enforcement

The current communication is being viewed as a compliance window rather than an enforcement action, allowing taxpayers to correct omissions voluntarily before stricter proceedings are initiated. Failure to respond may expose taxpayers to penalties, reassessment, and prosecution under anti-black money laws.

Tax professionals are urging recipients of such emails to act promptly, gather overseas financial details, and revise their returns well before the December 31 deadline to avoid penal consequences.

Read More: GYANOTSAV 2026 to Spotlight GSTAT Practice, Tax Litigation, AI in Law : REGISTER NOW!