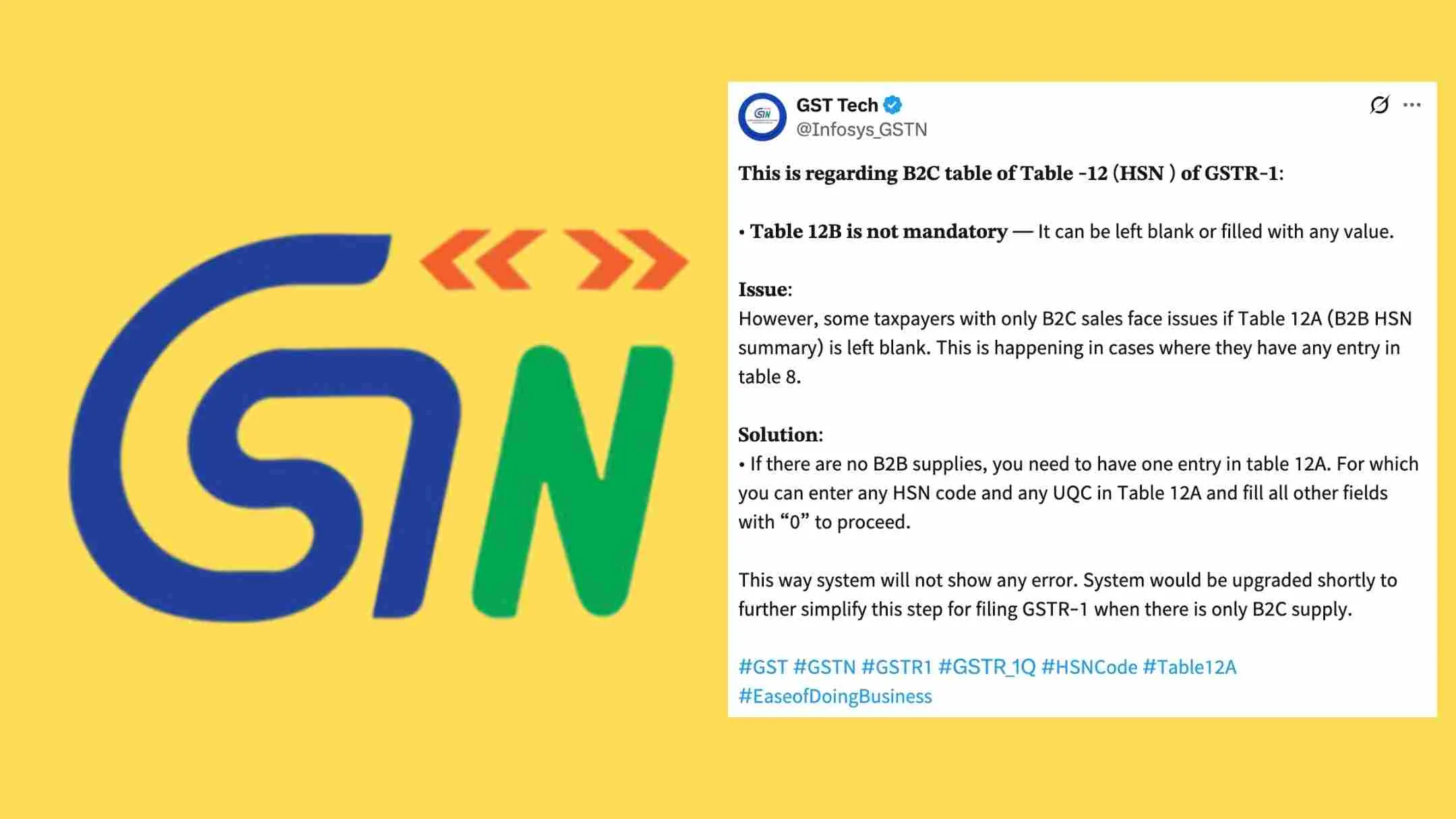

The Goods and Services Tax Network (GSTN), through its technical arm GST Tech (@Infosys_GSTN), has issued a clarification regarding the filing of Table 12B (HSN – B2C) in GSTR-1.

It has been confirmed that Table 12B is not mandatory and may be left blank or filled with any value without affecting the return filing.

The clarification comes in response to issues faced by taxpayers who deal exclusively in Business-to-Consumer (B2C) sales. According to GSTN, some of these taxpayers are encountering system errors when Table 12A (HSN summary for B2B sales) is left blank — especially in scenarios where there is an entry in Table 8. This has led to confusion, as these businesses have no B2B transactions to report in Table 12A.

To resolve this, GSTN has provided a temporary solution. Taxpayers with no B2B supplies are advised to make one dummy entry in Table 12A. This can be done by entering any valid HSN code and any Unit Quantity Code (UQC), while filling all the other fields in Table 12A with the value “0”. This approach will prevent the system from showing an error and will allow the filing to proceed smoothly.

GSTN has also assured users that the system will soon be upgraded to address this issue permanently. The upcoming update is expected to simplify the GSTR-1 filing process, particularly for businesses that only deal in B2C supplies.

This clarification is a welcome step toward reducing compliance burdens and ensuring ease of doing business under the GST regime.