The Goods and Service Tax Networks (GSTN) has implemented a validation process for cases where a taxpayer attempts a non-core amendment to update bank account details.

The GSTN requested the has Taxpayers to follow the procedure outlined in the link provided below while adding bank account details on the portal.

Table of Contents

Procedure To Add Bank Account Details

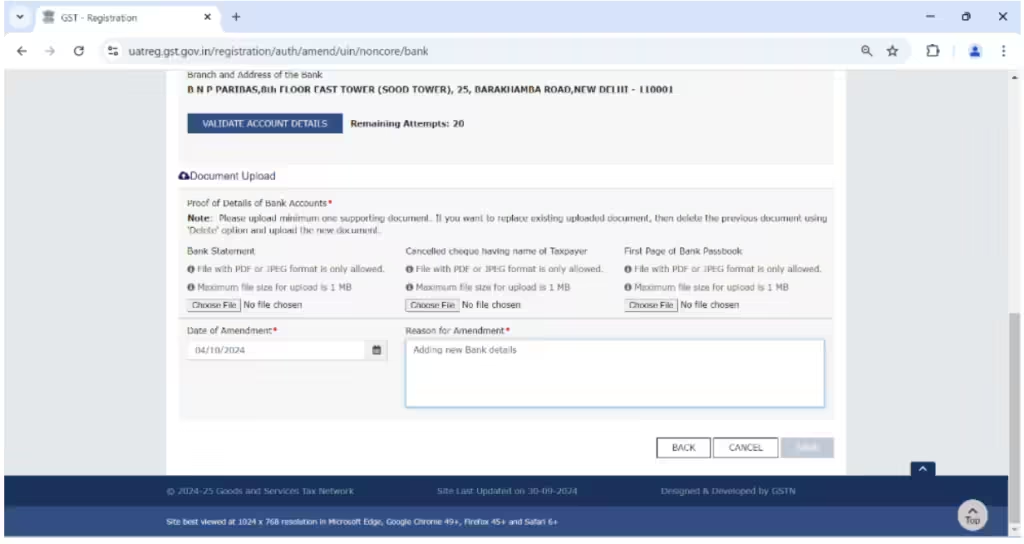

When the bank account details are entered, the taxpayer is required to click on “VALIDATE ACCOUNT DETAILS” button.

Prior to clicking the “Validate Account” button, the “Save” button at the bottom of the screen as shown remains disabled.

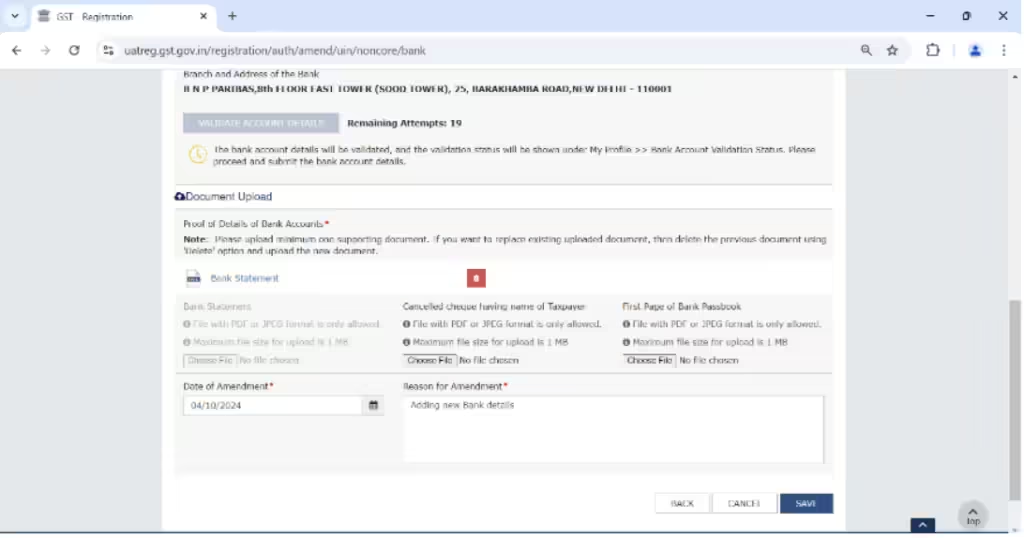

The “Save” button will become active only after the “Validate Account Details” button is clicked.

Notification Details

Click Here To Read Notification Details