Email Claims Manual Verification for Rs. 50,000 Refund

The Government of India has issued an urgent advisory cautioning taxpayers against fraudulent emails purporting to be from the Income Tax Department, which falsely claim that “manual verification” is required to process tax refunds

Fraudulent Email Claims Refund of Rs. 50,000

The fake email, designed to closely resemble official communication from the Central Board of Direct Taxes (CBDT), falsely claims that the recipient is eligible for an income tax refund of ₹50,000 for the Assessment Year 2024-25 and instructs the taxpayer to “Verify & Confirm Now” through a suspicious link. It misleadingly cites RBI and PMLA norms to justify the need for beneficiary confirmation.

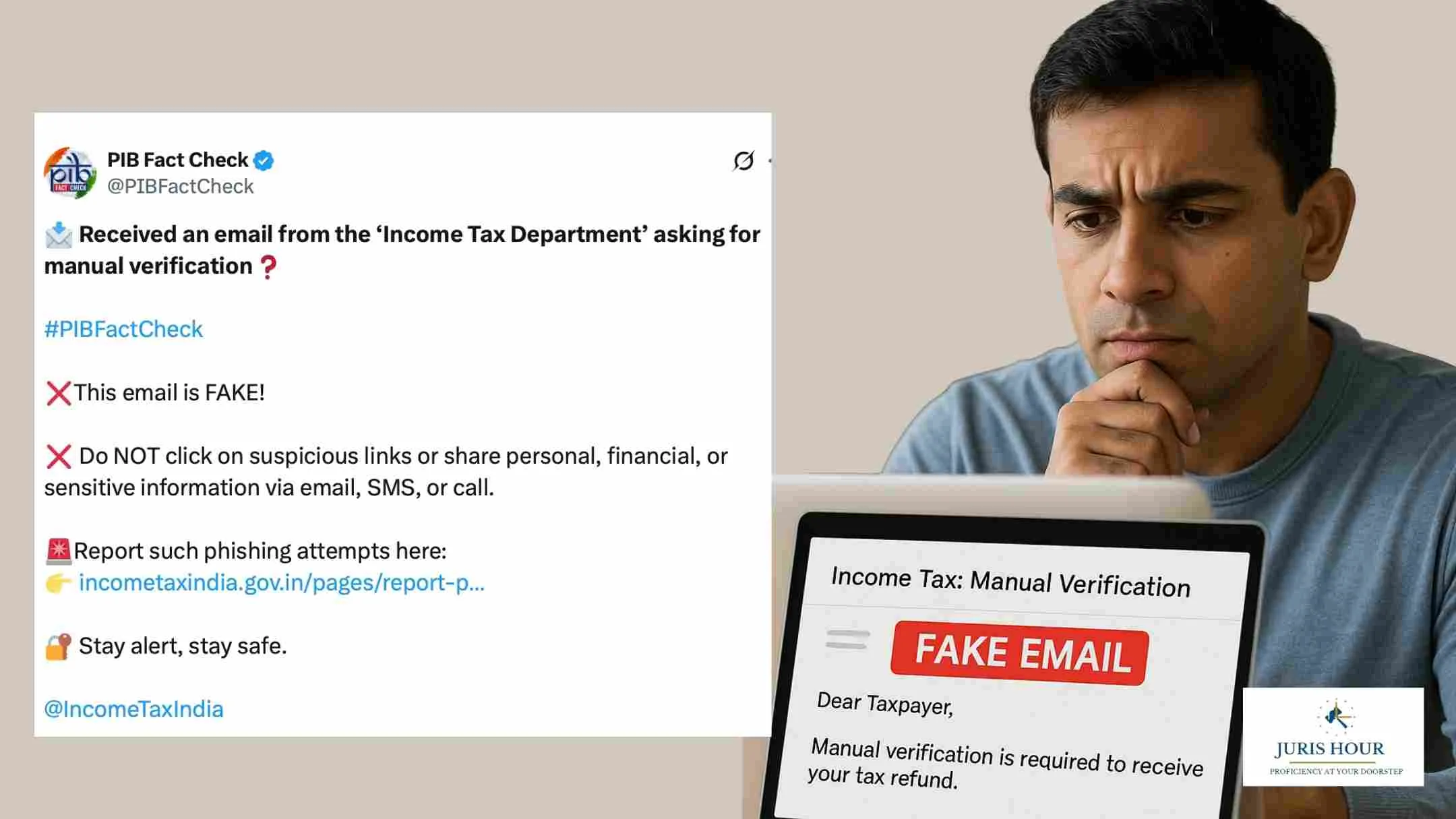

PIB Fact Check Confirms It’s a Scam

In response, the Press Information Bureau (PIB) Fact Check unit has categorically debunked this email, labeling it fake and warning citizens not to click on suspicious links or share personal, financial, or sensitive information through email, SMS, or calls.

“Received an email from the ‘Income Tax Department’ asking for manual verification? This email is fake,” PIB tweeted. The department also encouraged users to report phishing attempts via the official portal: https://incometaxindia.gov.in/pages/report-phishing.aspx.

Fake Justification Misleading Taxpayers

The fake message includes official-sounding language, forged headers, and even a fake helpline number to mislead users. It falsely claims, “As per latest RBI & PMLA norms, all refunds above ₹25,000 require recipient confirmation,” which has been denied by the authorities.

What to Do If You Receive Such an Email

- Do not click on any links or attachments in the email.

- Do not share PAN, Aadhaar, bank account, or login credentials.

- Verify all official communication through the official portal www.incometax.gov.in.

- Report phishing emails immediately at https://incometaxindia.gov.in/pages/report-phishing.aspx.

Ministry Clarifies Income Tax Does Not Ask for Sensitive Info via Email

The Ministry of Finance reiterated that the Income Tax Department does not seek sensitive information like PAN, Aadhaar, or bank details via email or SMS for refund processing. The public has been urged to stay vigilant and avoid falling prey to such phishing scams.