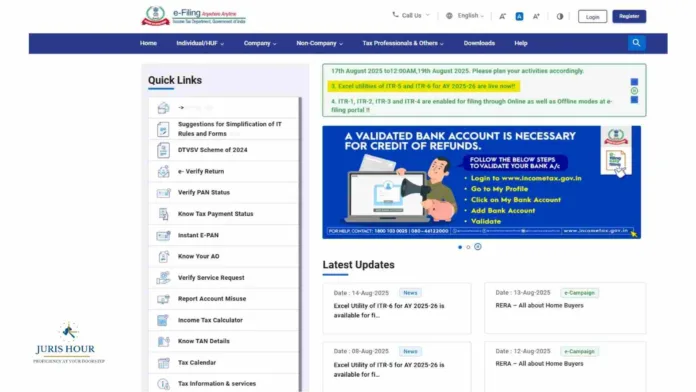

The Income Tax Department has announced that the Excel Utility for ITR-6 for the Assessment Year (AY) 2025–26 is now live and available for taxpayers to file their returns. The utility can be accessed through the official e-filing portal at incometax.gov.in/iec/foportal.

ITR-6 is applicable to companies other than those claiming exemption under Section 11 of the Income Tax Act, 1961 (such as charitable or religious trusts). Taxpayers can now download the Excel Utility, prepare their returns offline, and upload them on the portal for filing.

The e-filing portal also reminds taxpayers to ensure that their bank accounts are validated for seamless credit of refunds. Users can validate their accounts by logging in to the portal, navigating to ‘My Profile’, selecting ‘My Bank Account’, and adding or validating their bank details.

With the utility going live ahead of the filing deadlines, the department has urged companies to plan their compliance activities in advance to avoid last-minute rush.

Read More: CBDT, CBIC Struggle With Over One-Third Vacancies Amid Major Tax Reforms