Notification - Page 2

GSTN Issues FAQs On Handling of Inadvertently Rejected records on IMS

The Goods and Service Tax Network (GSTN) has issued the Frequently Asked Questions (FAQs) on Handling of Inadvertently...

ICETAB Launched to Boost Export Efficiency and Transparency at CBIC...

The Central Board of Indirect Taxes and Customs (CBIC) launched a cutting-edge digital initiative, ICETAB, at the 2-day...

Advisory to file pending returns before expiry of three years: GSTN

The Goods and Service Tax Network (GSTN) has issued the advisory to file pending returns before expiry of three years. ...

DGFT Restricts Liquid Gold Import With Immediate Effect

The Directorate General Of Foreign Trade (DGFT) has restricted liquid gold import with immediate effect. The changes...

Delhi High Court Bar Association Condemns ED's Summons to Senior...

The Delhi High Court Bar Association (DHCBA) has strongly condemned the Enforcement Directorate’s (ED) reported attempt...

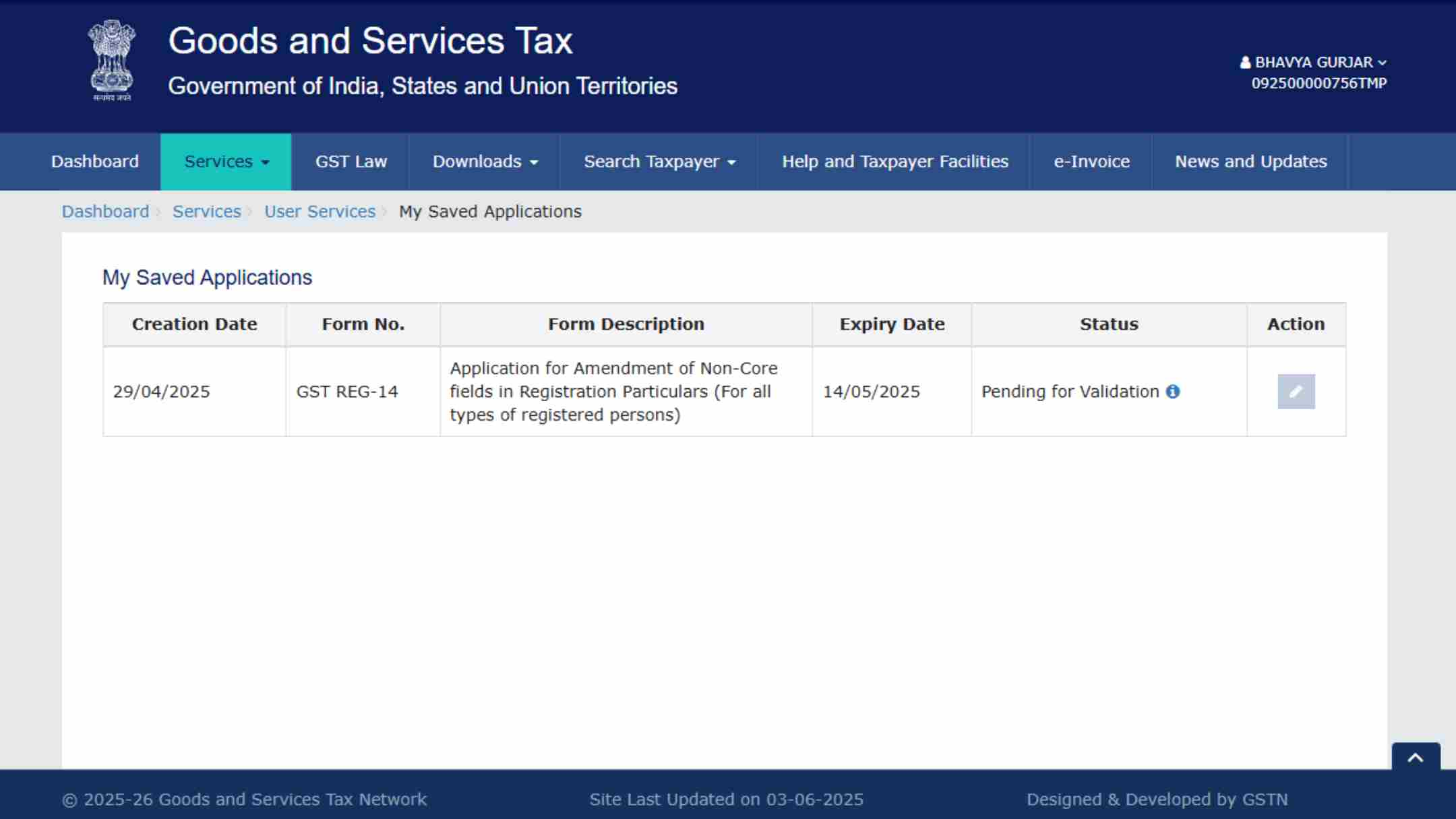

GST Amendment Application Stuck for Over 50 Days, Taxpayer Seeks Help

A taxpayer's application for a routine GST amendment has remained "Pending for Validation" for over 50 days on the GSTN...

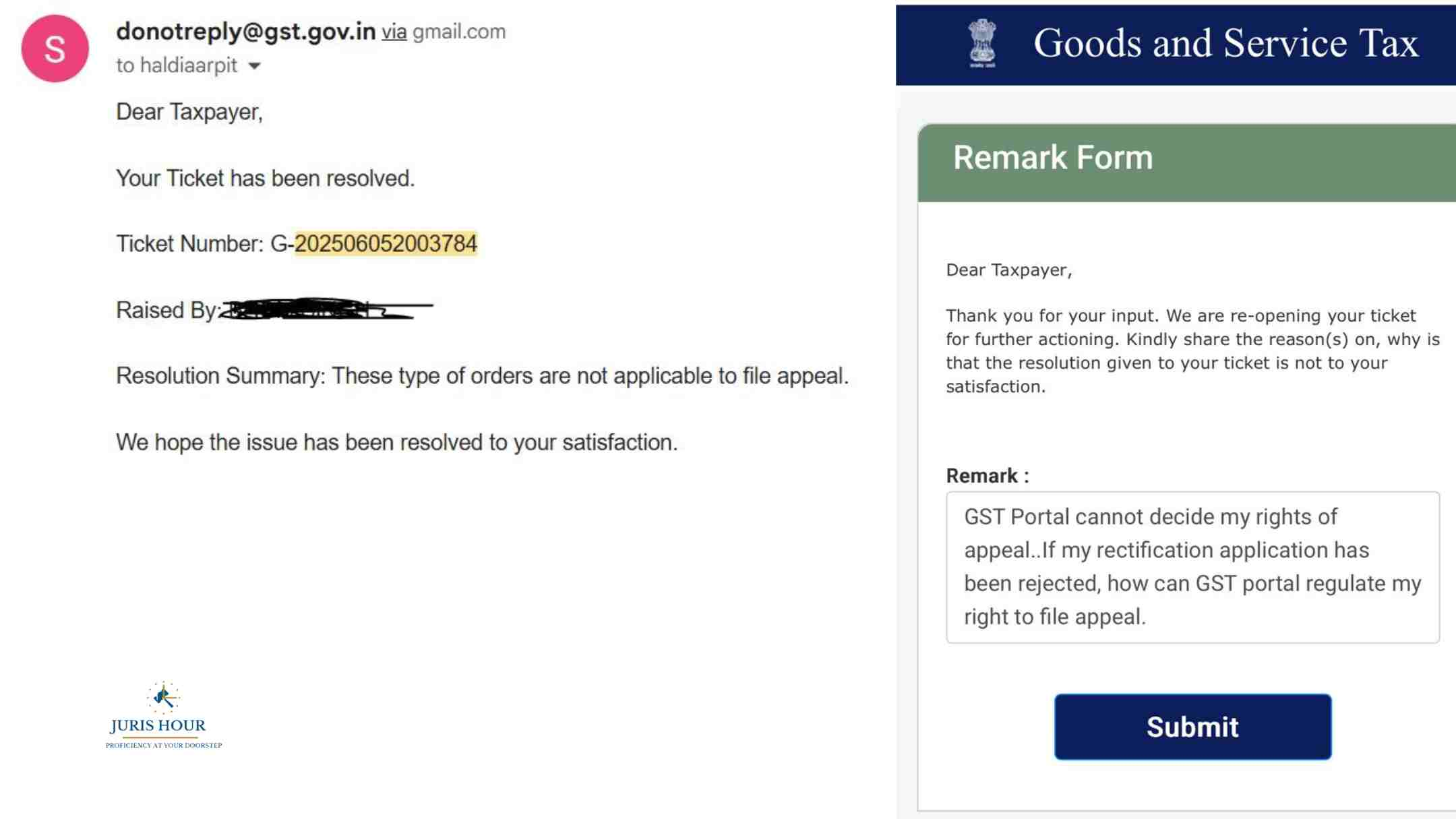

Taxpayer Denied Statutory Right to Appeal Due to GST Portal Glitch:...

A recent incident has sparked concern among tax professionals and taxpayers alike, after a registered taxpayer was...

CBDT Issues Guidelines for Compulsory Selection of Returns for...

The Central Board of Direct Taxes (CBDT) has issued detailed guidelines for the compulsory selection of income tax...

Enhanced Inter-Operable Services Between E-Way Bill Portals...

The Goods and Service Tax Network (GSTN) has introduced enhanced inter-operable services between e-way bill portals. ...

CBDT Notifies NABARD Zero Coupon Bonds Worth ₹19,500 Crore as Per...

The Central Board of Direct Taxes (CBDT) has officially notified a new issue of zero coupon bonds by the National Bank...

CBIC Launches GST Pakhwada from June 16 to 30; Helpdesks Set Up Across...

As part of the celebrations marking GST Day on July 1, the Central Board of Indirect Taxes and Customs (CBIC) has...

ICAI to Launch Live Virtual Revisionary Classes for CA Intermediate...

In a bid to support Chartered Accountancy students in their exam preparation, the Institute of Chartered Accountants of...