A recent incident has sparked concern among tax professionals and taxpayers alike, after a registered taxpayer was reportedly denied the right to file an appeal against an order rejecting a rectification application, owing to technical limitations of the GSTN portal.

According to details shared, an order dated October 10, 2024, was passed against the taxpayer under the CGST Act, 2017. Following this, the taxpayer filed a rectification application under Section 161 of the CGST Act on December 16, 2024. This application was subsequently rejected through a formal order dated March 21, 2025.

The taxpayer sought to challenge the said rejection by filing an appeal under Section 107 of the CGST Act. However, while attempting to initiate the appeal process on the GST portal, the system refused to accept the application, citing that the Reference Number of the Rectification Rejection Order was “not applicable for appeal filing.”

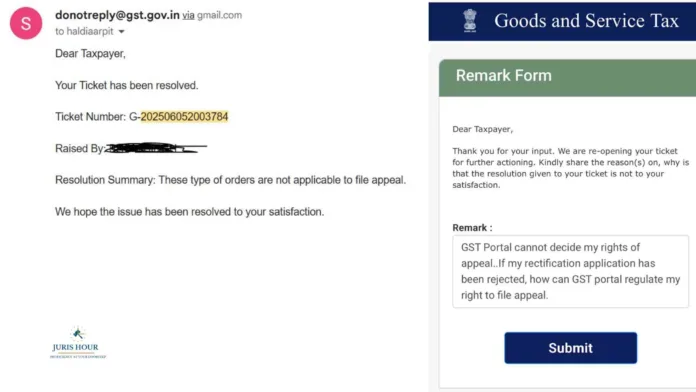

A grievance was immediately filed by the taxpayer with GSTN (operated by Infosys) under Reference No. G-202506052003784, dated June 5, 2025. The response received was that “these types of orders are not applicable to file appeal,” effectively closing the complaint without providing any remedy.

The taxpayer, dissatisfied with the resolution, requested the reopening of the complaint and argued that the right to appeal is a statutory remedy enshrined under Section 107 of the CGST Act. The rejection of the rectification application constitutes a quasi-judicial order that is appealable in nature, and no administrative or software limitation should abrogate this right.

“This is a clear violation of our statutory right,” said the aggrieved taxpayer. “The portal exists to enable access to justice—not restrict it. The rejection of our appeal filing due to portal design is arbitrary and contrary to the spirit of the law.”

Legal experts agree that Section 107 of the CGST Act provides a broad right to appeal “any decision or order passed” by an adjudicating authority, which would logically include orders rejecting rectification requests.

The matter has now been escalated publicly on social media, tagging authorities such as @Infosys_GSTN, @FinMinIndia, and @GST_Council, with a call for immediate correction of the portal’s configuration and enforcement of taxpayers’ rights.

The incident underscores an ongoing concern among stakeholders regarding the digital infrastructure of the GST system. While automation and e-governance have been central to the GST regime, technical bottlenecks and platform-related denials of legal rights raise serious questions about access to justice in a digital-first tax environment.

Update Awaited from Authorities

As of now, there has been no formal response from Infosys or the GSTN, nor have any clarifications been issued by the Central Board of Indirect Taxes and Customs (CBIC) or the Ministry of Finance. Tax professionals across the country are closely watching the developments, as any precedent in this regard could affect many similar cases.