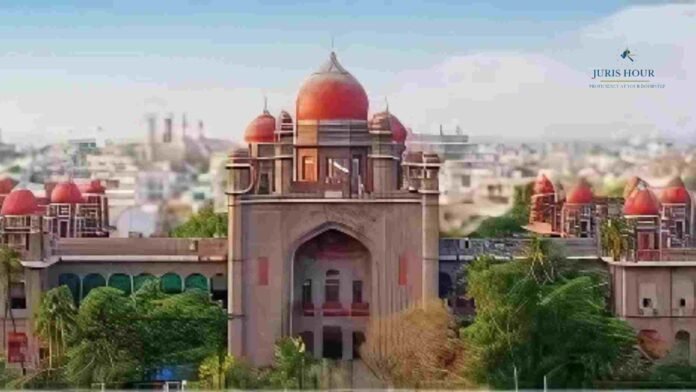

The Telangana High Court has granted interim relief to assessee by staying the recovery of GST demand arising out of a composite assessment order that covered four different financial years, holding that the issues raised require detailed examination. The bench of Chief Justice Aparesh Kumar Singh and Justice G.M. Mohiuddin stayed the operation of the…

Telangana High Court Stays GST Demand Raised Through Composite Order Covering 4 FYs

Nikhil Bhandari

Nikhil Bhandari is a Chartered Accountant and a Indirect Tax professional with over 4.5 years of post-qualification experience in tax advisory, compliance management, and tax process optimization. Associated with SDU LLP since August 2015 spanning his articleship through to his current role as Assistant Manager Nikhil has uniquely navigated India’s transition from the legacy tax regime into the GST era.His expertise encompasses both strategic advisory and Indirect Tax litigation, where he represents clients in complex disputes across the manufacturing, service, and e-commerce sectors. By providing high-level counsel to corporate leadership, he ensures that tax positions are not only robust and compliant but also structured for long-term operational efficiency.Beyond his core practice, Nikhil is a proactive contributor to the GST ecosystem. He is dedicated to tracking and analyzing judicial precedents from various High Courts and the Supreme Court, fostering greater clarity and ease of access to tax intelligence for the wider professional community.

- Tags

- Composite Order

Latest articles

Case Compilation

JURISHOUR | TAX LAW DAILY BULLETIN : MARCH 4, 2026

Here’s the Tax Law Daily Bulletin for March 4, 2026.GSTEXECUTIVE CIRCULAR CAN’T CURTAIL STATUTORY...

Indirect Taxes

When Service Tax Is Shown Separately In Invoices, Assessee Can’t Later Claim Cum-Tax Benefit Merely Because Tenant Failed To Pay Tax: CESTAT

The Bengaluru Bench of Customs, Excise and Service Tax Appellate Tribunal (CESTAT), has upheld...

Direct Tax

ITAT Remands Rs. 1.47 Crore Addition Over Unexplained Cash Deposits Under S. 69A

The Ahmedabad Bench of Income Tax Appellate Tribunal (ITAT) has set aside an addition...

Indirect Taxes

Dept. Failed to Prove Clandestine Removal In ‘Gold Mohar’ Pan Masala Case: CESTAT Quashes Cash and Goods Confiscation

The Allahabad Bench of Customs, Excise & Service Tax Appellate Tribunal (CESTAT) has set...

More like this

Case Compilation

JURISHOUR | TAX LAW DAILY BULLETIN : MARCH 4, 2026

Here’s the Tax Law Daily Bulletin for March 4, 2026.GSTEXECUTIVE CIRCULAR CAN’T CURTAIL STATUTORY...

Indirect Taxes

When Service Tax Is Shown Separately In Invoices, Assessee Can’t Later Claim Cum-Tax Benefit Merely Because Tenant Failed To Pay Tax: CESTAT

The Bengaluru Bench of Customs, Excise and Service Tax Appellate Tribunal (CESTAT), has upheld...

Direct Tax

ITAT Remands Rs. 1.47 Crore Addition Over Unexplained Cash Deposits Under S. 69A

The Ahmedabad Bench of Income Tax Appellate Tribunal (ITAT) has set aside an addition...