The Goods and Services Tax Network (GSTN) has introduced a major update to the GST common portal, operationalizing a simplified registration process aimed at small and low-risk taxpayers. Under the new system, eligible applicants can now obtain GST registration within three working days, provided they fulfill the prescribed conditions and complete Aadhaar authentication.

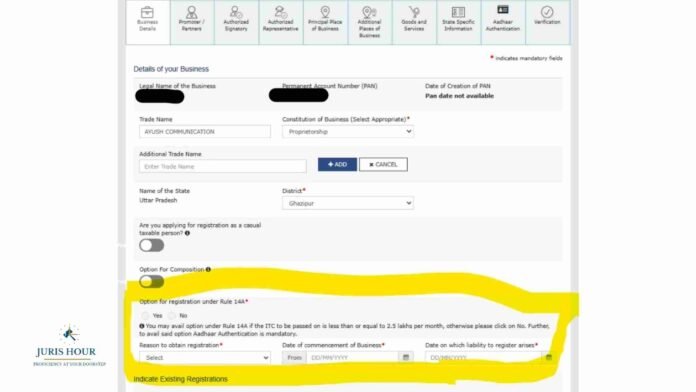

The new feature appears prominently in the “Details of Your Business” section of the online GST registration form. It includes a simplified option for registration under Rule 14A, specifically designed for taxpayers whose input tax credit (ITC) to be passed on is up to ₹2.5 lakh per month.

Applicants choosing this route must complete Aadhaar-based authentication, which is now mandatory to avail of the fast-track process. The system automatically flags high-risk applications or incomplete submissions for manual verification, which could extend the approval timeline beyond three days.

According to GSTN officials, this initiative is part of the government’s ongoing efforts to enhance ease of doing business and to ensure faster onboarding of genuine, low-risk businesses while maintaining robust fraud checks.

Taxpayers are advised to upload all required documents, including proof of business and address. Ensure Aadhaar authentication of the proprietor or authorized signatory. Provide accurate details regarding the reason for registration and the commencement date of business.

This update is expected to significantly reduce registration delays for small traders, startups, and service providers—boosting compliance and simplifying entry into the GST ecosystem.

Read More: Income Tax Dept. Uncovers Rs. 5,500 Crore Fake Political Donations Racket