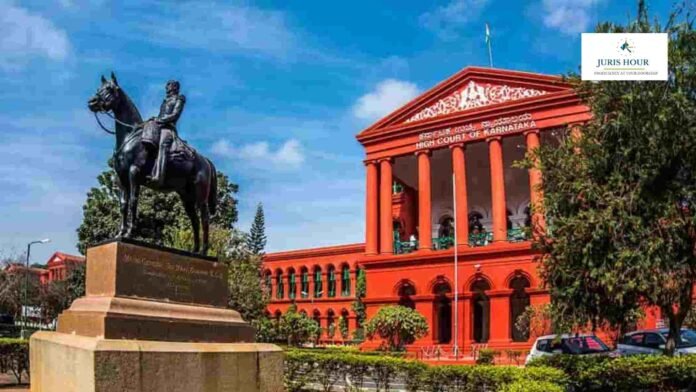

The Karnataka High Court has set aside a substantial GST demand raised against pharmaceutical major Micro Labs Limited, holding that distribution of common Input Tax Credit (ITC) through the Input Service Distributor (ISD) mechanism was not mandatory during the relevant period and that cross-charging through tax invoices was legally permissible. The bench of Justice S.R….

ISD Mechanism Not Mandatory for Distribution of Common ITC: Karnataka High Court

0

140

Nikhil Bhandari

Nikhil Bhandari is a Chartered Accountant and a Indirect Tax professional with over 4.5 years of post-qualification experience in tax advisory, compliance management, and tax process optimization. Associated with SDU LLP since August 2015 spanning his articleship through to his current role as Assistant Manager Nikhil has uniquely navigated India’s transition from the legacy tax regime into the GST era.His expertise encompasses both strategic advisory and Indirect Tax litigation, where he represents clients in complex disputes across the manufacturing, service, and e-commerce sectors. By providing high-level counsel to corporate leadership, he ensures that tax positions are not only robust and compliant but also structured for long-term operational efficiency.Beyond his core practice, Nikhil is a proactive contributor to the GST ecosystem. He is dedicated to tracking and analyzing judicial precedents from various High Courts and the Supreme Court, fostering greater clarity and ease of access to tax intelligence for the wider professional community.