The Goods and Services Tax (GST) framework continues to evolve in India, with fresh emphasis on simplifying registration processes and raising awareness among businesses and service providers.

The latest update outlines the conditions under which GST registration becomes mandatory, the documents and procedures involved, as well as compliance options tailored for small businesses.

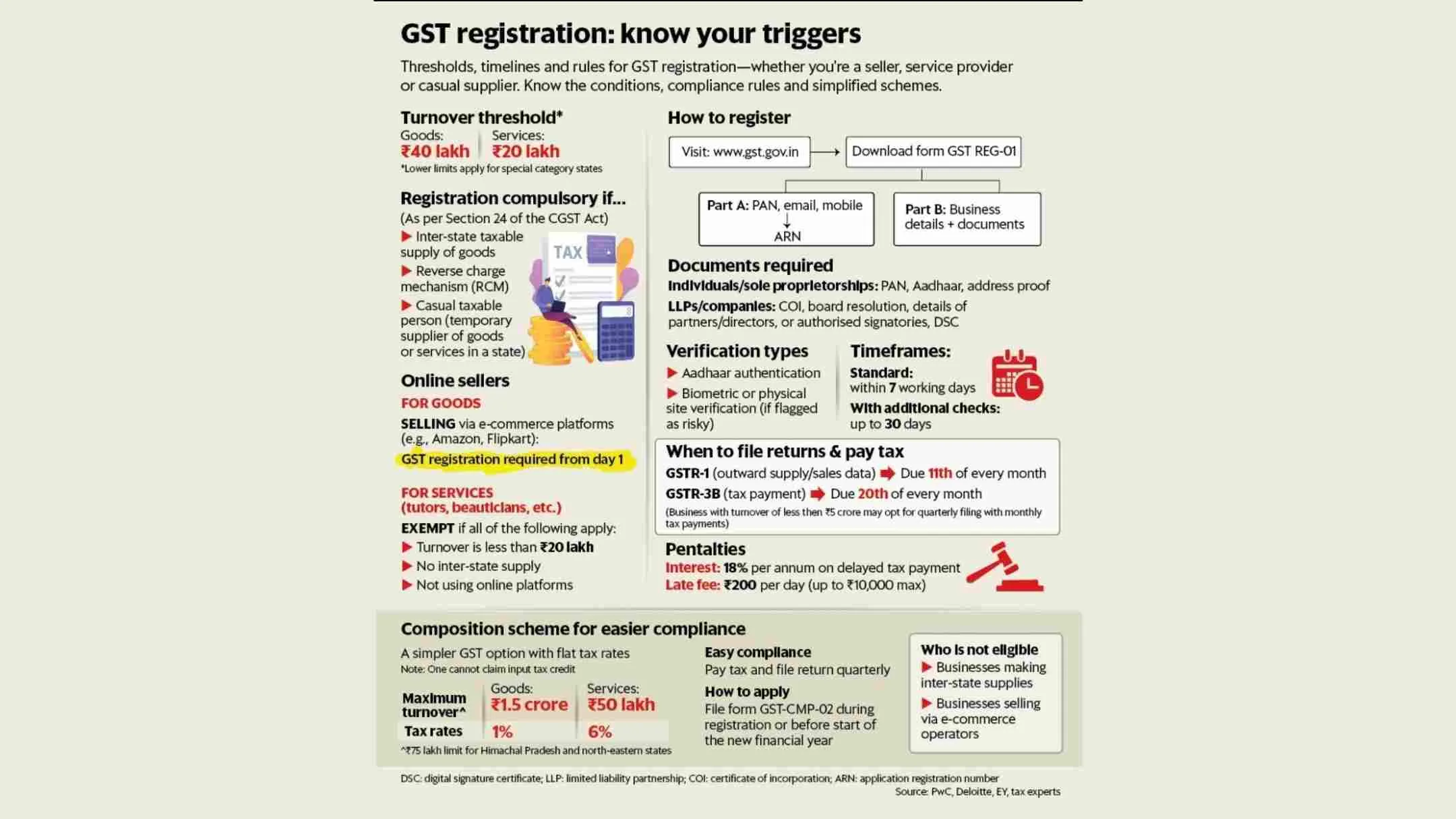

As per the current GST laws, registration is required once a business crosses the prescribed turnover threshold — ₹40 lakh for goods and ₹20 lakh for services. However, these limits are lower in certain special category states. In addition to turnover, GST registration is compulsory under specific circumstances, regardless of income. These include inter-state taxable supply of goods, transactions falling under the reverse charge mechanism, and in the case of a casual taxable person — one who supplies goods or services occasionally in a state where they don’t have a fixed place of business.

One of the key highlights pertains to online sellers. Businesses engaged in selling goods through e-commerce platforms such as Amazon or Flipkart are required to register for GST from day one, irrespective of their turnover. In contrast, service providers — like tutors, beauticians, and freelancers — are exempt from registration if their annual turnover is below ₹20 lakh, they operate only within a single state, and do not sell through e-commerce operators.

The registration process itself has been made user-friendly and fully digital. Applicants can register through the GST portal (www.gst.gov.in) by filling out Form GST REG-01, which is divided into two parts. Part A requires basic details such as PAN, email, and mobile number, while Part B collects business information and supporting documents. Individuals and sole proprietors need to provide documents such as PAN, Aadhaar, and address proof, whereas companies and LLPs must furnish incorporation certificates, board resolutions, and digital signature certificates (DSCs).

Verification of the application includes Aadhaar-based authentication, and if flagged as high-risk, the applicant may be subjected to biometric verification or a physical site inspection. Standard registration timelines are within seven working days, although the process can take up to 30 days in cases requiring additional scrutiny.

Post-registration, businesses must comply with return filing obligations. The GSTR-1, which includes outward supply or sales data, is due by the 11th of each month. The GSTR-3B, which includes tax payment details, is due by the 20th. Businesses with turnover below ₹5 crore may opt to file returns quarterly, though they must still pay taxes monthly. Failure to comply attracts penalties in the form of 18% interest per annum on delayed tax payments and a late fee of ₹200 per day, subject to a maximum cap of ₹10,000.

To ease the compliance burden for small taxpayers, the government continues to offer the Composition Scheme. This scheme allows businesses to pay tax at a flat rate with minimal documentation and quarterly return filing. Goods suppliers with an annual turnover of up to ₹1.5 crore can pay tax at 1%, while service providers earning up to ₹50 lakh annually are subject to a 6% rate. However, the scheme is not available to businesses making inter-state supplies or those using e-commerce platforms.

By providing clear triggers and streamlined procedures, the government aims to promote voluntary compliance and reduce administrative burdens on taxpayers. These measures are expected to enhance transparency, increase GST enrollment, and ensure that even the smallest of enterprises can operate within the bounds of tax law confidently and efficiently.