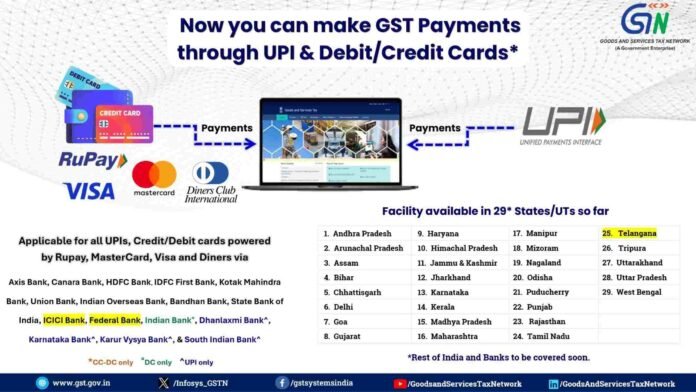

The Goods and Services Tax Network (GSTN) has enabled GST payments through UPI as well as Credit and Debit Cards in Telangana, expanding digital payment options for taxpayers in the State.

With this rollout, registered taxpayers in Telangana can now make GST payments using UPI, Credit Cards, and Debit Cards directly through the GST portal, reducing reliance on traditional net banking channels and improving ease of payment.

Enabled Through ICICI Bank and Federal Bank

As per GSTN’s official communication, the facility in Telangana has been enabled through ICICI Bank and Federal Bank as authorised payment gateways. Taxpayers can use cards powered by RuPay, Visa, Mastercard, and Diners Club International, subject to bank-specific eligibility.

The move is expected to particularly benefit small businesses, MSMEs, and individual taxpayers, who often face operational challenges with limited net banking options.

Part of Pan-India Digital Expansion

Telangana becomes one of 29 States and Union Territories where GST payments through UPI and card-based modes have been activated so far. Other States already covered include Maharashtra, Gujarat, Karnataka, Tamil Nadu, Delhi, Uttar Pradesh, West Bengal, and Kerala, among others.

GSTN has clarified that the remaining States/UTs and banks will be onboarded in phases, with full national coverage expected soon.

How the Facility Works

Taxpayers can select UPI or Card payment modes while generating a GST challan on the GST portal. Depending on the bank and instrument used:

- Some banks allow Credit and Debit Card payments

- Others may support only UPI or Debit Cards

- Transaction limits and charges, if any, will be governed by bank and NPCI guidelines

Boost to Ease of Doing Business

The introduction of UPI and card-based GST payments aligns with the Government’s broader push towards digital public infrastructure and ease of doing business. By offering faster settlement, real-time confirmation, and wider accessibility, the new payment modes are expected to enhance compliance efficiency and reduce payment-related grievances.

GSTN has advised taxpayers to verify bank-specific conditions before initiating payments and to ensure timely reconciliation of challans.

Read More: CBDT Guidelines to Become Binding on Tax Dept. and Taxpayers