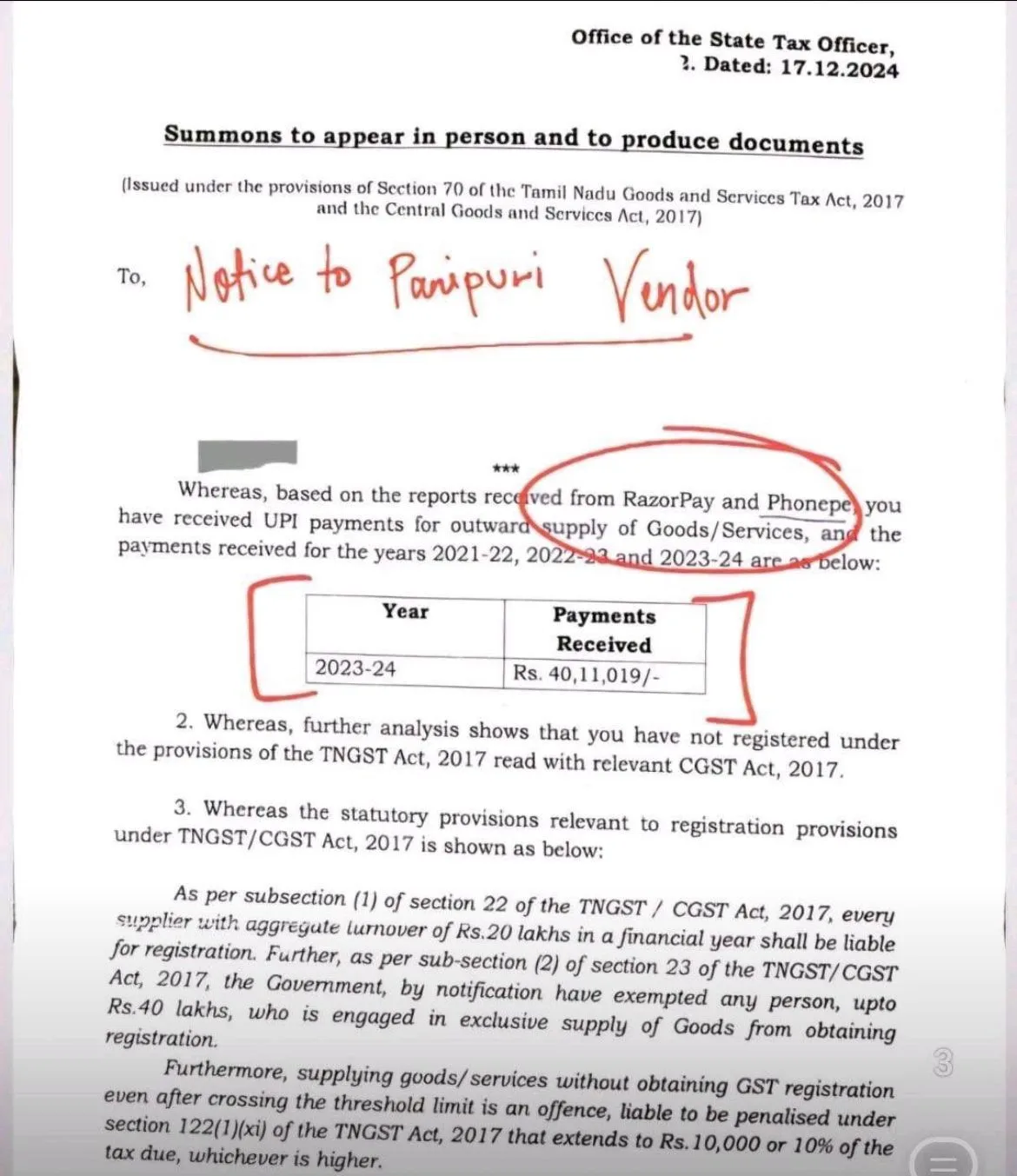

A Pani Puri wala received a GST notice for non registration of GST.

The Department is now taking reports from Phone Pe/Razor Pay etc regarding your UPI transactions. The Pani Puri has received more than Rs.40 lakhs only from UPI transactions.

As per subsection (1) of section 22 of the TNGST/CGST Act, 2017, every supplier with aggregate turnover of Rs.20 lakhs in a financial year shall be liable for registration. Further, as per sub-section (2) of section 23 of the TNGST/CGST Act, 2017, the Government, by notification has exempted any person, upto Rs.40 lakhs, who is engaged in exclusive supply of Goods from obtaining registration.

The supplying goods/services without obtaining GST registration even after crossing the threshold limit is an offence, liable to be penalised under section 122(1)(xi) of the TNGST Act, 2017 that extends to Rs. 10,000 or 10% of the tax due, whichever is higher.