The Federation of Automobile Dealers Association (FADA) has moved the Supreme Court after facing losses estimated at over ₹2,500 crore due to the lapse of accumulated compensation cess following the rollout of the new GST 2.0 regime on September 22, 2025.

The dealers’ body has argued that automobile dealers across India are left holding large stocks of vehicles purchased before the GST 2.0 transition, on which compensation cess had already been paid. With the cessation of the cess under the new tax structure, these credits have become unusable, effectively turning into sunk costs for the sector.

Dealers seek refund or adjustment relief

In its plea, FADA intends to request that the unutilised compensation cess balances, as reflected in dealers’ ledgers as of September 21, 2025, be permitted for adjustment against regular GST liabilities or alternatively refunded.

Despite repeated representations to senior government officials and Cabinet ministers, no relief has been announced. According to sources in the Union Finance Ministry, the government has decided against extending any relief or transitional provisions to dealers in respect of the lapsed compensation cess.

Earlier, the association had urged the Finance Ministry to transfer the balance amount in the compensation cess credit ledger to the IGST or CGST ledger by September 21 to prevent the loss. However, this request was not accepted.

“Industry facing huge financial strain,” says FADA

“We are thankful for the introduction of GST 2.0, which has revived consumer sentiment and boosted demand for passenger cars, especially in the entry-level segment. But the inventory currently held by dealers carries compensation cess paid under the old regime. Despite our discussions with government authorities, there has been no positive signal. The financial impact is severe and unrecoverable, compelling us to seek judicial intervention,” said Sachin Vasantrao Mahajan, Chairperson of FADA Maharashtra, in a statement to businessline.

He added that the accumulated loss could erase the profit margins of several dealerships for the entire financial year, particularly for smaller players operating on thin margins.

GST 2.0 brings rate cuts, but dealers bear transition cost

As part of the GST 2.0 reforms, the GST Council reduced tax rates on passenger cars measuring up to four metres in length and equipped with engines up to 1,200cc from 28% to 18%, while simultaneously abolishing the compensation cess applicable to these vehicles. The move has made cars more affordable and spurred demand, but the transition has created a fiscal mismatch for dealers holding pre-reform stock.

Dealers escalate issue to top leadership

In addition to the planned Supreme Court petition, FADA has written to the Prime Minister and the Finance Minister, seeking immediate intervention to prevent financial distress across the dealership network. Internal meetings within the association have highlighted growing frustration among members over the government’s inaction.

A senior FADA member, requesting anonymity, said, “We have met all relevant officials in the Union Ministry, but there is no indication of relief. The issue has become critical for dealers nationwide, and approaching the Supreme Court appears to be the only recourse left.”

Past legal interventions

This would not be FADA’s first legal confrontation with the government. The association had previously approached the Supreme Court seeking permission for the sale of BS-III vehicles and later filed another plea seeking an extension for the sale and registration of BS-IV vehicles when emission standards changed.

With the stakes now running into thousands of crores, the association’s impending petition could become a key test case for the treatment of transitional tax liabilities under India’s evolving GST regime.

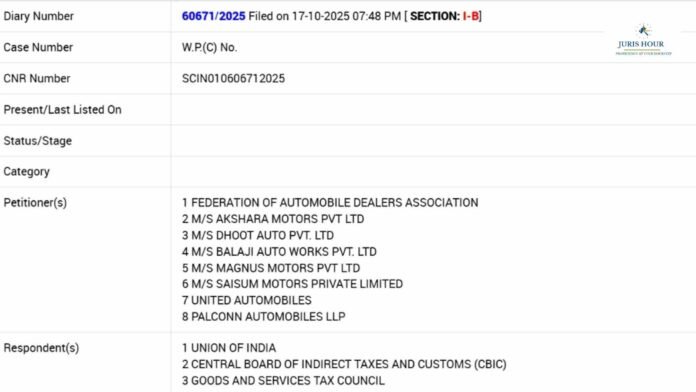

Case Details

Case Title: FEDERATION OF AUTOMOBILE DEALERS ASSOCIATION Versus UOI

Case No.: 60671/2025 Filed on 17-10-2025