Trinamool Congress leader Abhishek Banerjee on Thursday launched a sharp critique of the Goods and Services Tax (GST) framework, questioning the indirect tax burden on essential items used by lower-income households. His remarks came in response to statements by Union Finance Minister Nirmala Sitharaman regarding GST exemptions on key sectors.

In a detailed social media post, Banerjee thanked the Finance Minister for listening to his speech but accused the Centre of overlooking the lived realities of economically weaker sections. He argued that while certain headline exemptions exist under the GST regime, many associated or substitute goods that are actually consumed by poorer households continue to attract tax.

Also Read: What Union Finance Minister Nirmala Said

Milk and Powdered Alternatives

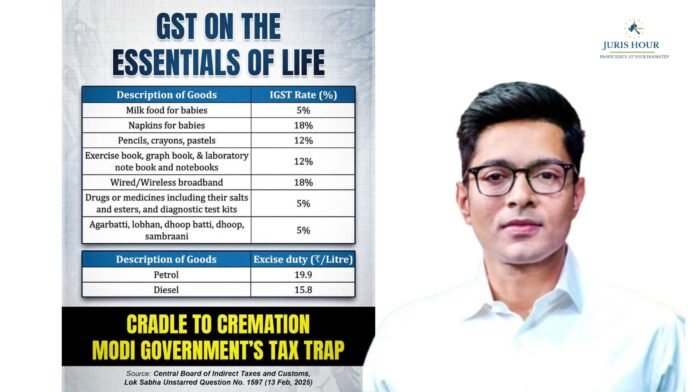

Banerjee pointed out that while fresh liquid milk is exempt from GST, powdered milk — often used by families that cannot afford fresh milk regularly — attracts 5% GST. He framed this as an example of what he described as a disconnect between statutory exemptions and consumer realities.

“Zero tax on what she can’t buy, 5% tax on what she’s forced to buy,” he stated, referring to economically constrained families.

Education-Related Supplies

The TMC MP further highlighted that textbooks are exempt from GST, but several supplementary educational materials are taxed. According to him, items such as graph paper, laboratory notebooks and crayons attract 12% GST. He argued that while textbooks may be technically tax-free, the overall cost of schooling includes a range of taxed materials that add to household expenses.

Healthcare Inputs and Medical Supplies

On healthcare, Banerjee acknowledged that medical consultation and treatment services are GST-exempt. However, he raised concerns over taxes on critical medical supplies and equipment. He cited oxygen cylinders, insulin injections and anesthesia as examples of items that attract GST at varying rates, arguing that essential healthcare inputs remain subject to indirect taxation.

His remarks appear to revisit debates that surfaced prominently during the COVID-19 pandemic, when GST on medical supplies became a politically sensitive issue.

Funeral-Related Goods

Banerjee also referred to funeral services, which are exempt from GST, but pointed out that related goods such as incense sticks (agarbatti) are taxed at 5%. He described this as symbolic of a broader structural issue within the tax system.

Wider Political Context

The exchange forms part of a larger political debate between opposition parties and the Centre over GST rationalisation and the alleged impact of indirect taxation on common citizens. Opposition leaders have repeatedly argued that while GST was introduced as a simplified, unified tax system, rate structures and classifications have resulted in uneven burdens across product categories.

The Finance Ministry has consistently maintained that GST rates are determined by the GST Council — a federal body comprising representatives from both the Union and State governments — and that many essential goods are either exempt or taxed at lower slabs.

Banerjee’s comments also referenced pending dues to West Bengal under centrally sponsored schemes such as MGNREGA, PMAY, PMGSY and Jal Jeevan Mission, linking fiscal policy to broader Centre–State financial relations.

Debate Over GST Rationalisation

The GST Council has in recent years undertaken efforts to rationalise tax slabs and address classification disputes. However, criticism persists regarding rate anomalies — particularly where final services are exempt but inputs remain taxable, or where substitute goods fall into different tax brackets.

Banerjee’s remarks underscore an ongoing political and policy debate: whether the GST framework adequately accounts for consumption patterns among low-income households and whether further rationalisation is required to reduce indirect tax burdens on essential goods.

As discussions on GST reforms continue, the issue is likely to remain a significant point of contention between opposition parties and the Centre, especially in the run-up to upcoming electoral cycles and fiscal policy reviews.