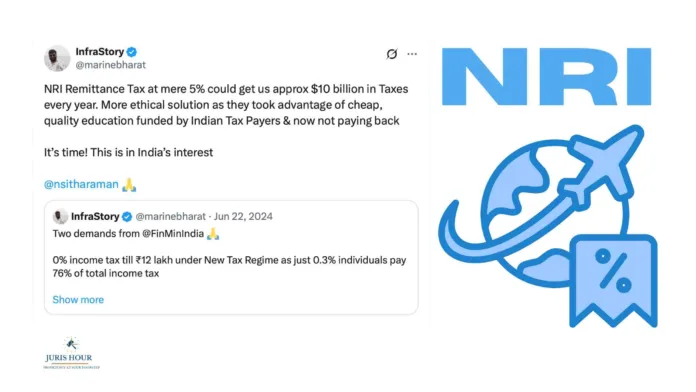

In a bold policy proposition that’s bound to ignite debate, economists and policymakers are examining the potential of a modest 5% tax on Non-Resident Indian (NRI) remittances, which could generate an estimated $10 billion annually for the Indian exchequer.

The rationale? A growing chorus of voices argues that many NRIs have benefitted immensely from India’s heavily subsidized, high-quality public education system — often funded by domestic taxpayers — only to later emigrate for better opportunities without contributing back proportionately to the country’s economy.

“It’s time,” say advocates, who believe that a nominal remittance tax is not only economically sound but also ethically justified. With India receiving over $100 billion in annual remittances, even a 5% levy could significantly boost public infrastructure, healthcare, and education.

“This isn’t about penalizing success,” said a senior economic advisor under anonymity. “It’s about ensuring a fair contribution from those who’ve been shaped by Indian taxpayers but now build wealth abroad.”

India’s premier institutes — from IITs and IIMs to state-run medical colleges — provide world-class education at a fraction of global costs, heavily subsidized by public funds. A large number of their alumni now form the top echelon of professionals in Silicon Valley, Wall Street, and beyond.

Critics argue such a tax could deter remittances and spark diplomatic friction. But proponents counter that most nations have some form of diaspora taxation, and India’s current policy — virtually tax-free remittance inflow — is overly lenient and unsustainable.

The proposal, if structured thoughtfully, could exclude smaller remittances sent for family support, focusing instead on high-value outflows and investments from ultra-high-net-worth NRIs.

The larger question: Should patriotism be priced? In a world of increasing national self-reliance and fiscal accountability, India must decide whether its diaspora — among the richest and most influential globally — should “give back” in more than just sentiment.

With a 5% remittance tax offering $10 billion a year, the choice might just write itself.

Read More: Faceless GST? Taxman May Soon Go Incognito