In a move that signals a sharp shift in the intensity of individual tax scrutiny, the Income Tax Department has issued a notice to a taxpayer asking for a detailed breakup of day-to-day household expenses — including haircuts, perfumes, cosmetics, restaurant visits, and even social-event costs.

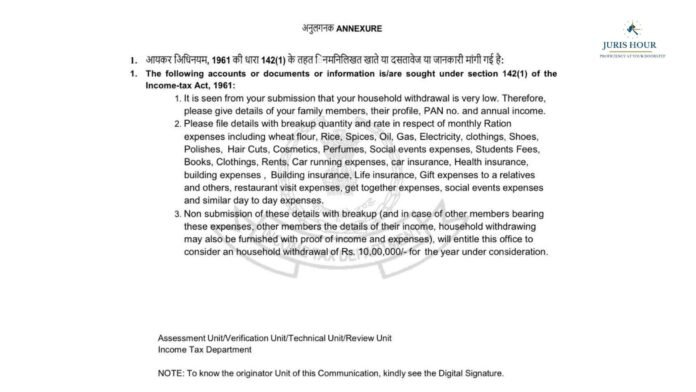

The notice, issued under Section 142(1) of the Income-tax Act, 1961, requires the taxpayer to furnish exhaustive details of family members, their PAN, annual income, and a category-wise breakup of monthly spending across numerous items. The annexure attached to the communication lists almost every conceivable personal expenditure — from wheat flour and rice to building insurance and gift expenses to relatives.

A Level of Detail Not Commonly Sought Earlier

While Section 142(1) empowers the Department to call for information during assessment, practitioners note that such granular questioning on personal living expenses — especially grooming products like perfumes and haircuts — reflects an upgraded approach where lifestyle patterns are being closely matched with reported income.

The assessment unit stated that the taxpayer’s household withdrawals appeared unusually low, prompting the request. The notice warns that non-submission of detailed breakup may lead the office to presume household expenses of ₹10 lakh for the year, a significant addition in cases where declared withdrawals are below that benchmark.

What the Department Wants

The taxpayer has been asked to provide:

- Names, profiles, PAN and annual incomes of all family members

- Month-wise breakup of ration and utility expenses

- Grooming expenses (haircuts, cosmetics, perfumes, polishes)

- Education, rent, clothing, restaurant, and social-event expenses

- Insurance premiums and vehicle running costs

- Proof of income and expenses for other family members, if they contribute

The scope and quantum of disclosures demanded go far beyond the traditional queries usually made during limited scrutiny or e-assessment.

Experts: “Not Routine Scrutiny Anymore”

Tax professionals say the notice is an example of how data-driven algorithms are pushing the Department to dig deeper into lifestyle-income mismatches.

According to senior practitioners, such notices reflect a growing trend where:

- Low household withdrawals trigger red flags

- Expenditure–income mismatch is treated as a potential undisclosed income indicator

- Family-wide financial profiling is becoming common in assessments

“This is no longer the routine scrutiny we saw even five years ago. The level of detail demanded—including cosmetics and perfumes—is unprecedented,” said a Delhi-based tax counsel.

Rising Use of AI and Data Analytics

The Department is believed to be using AI-assisted modules that analyze bank deposits, cash withdrawals, Form 26AS, AIS data, and consumption indicators. When the reported household spending appears inconsistent with lifestyle indicators, the system flags the case.

Taxpayers Advised to Maintain Documentation

Experts advise taxpayers to maintain:

- Records of household withdrawals

- Family income details

- Cash-flow statements

- Expense logs (even if approximate)

- Insurance and rental receipts

- Bank statements showing withdrawals used for monthly spending

With assessments becoming increasingly data-intensive, clarity and documentation are now crucial.