The Income Tax Department has disregarded the Bombay High Court’s ruling in the Hexaware Technologies case and proceeded to decide the matter on its own merits.

Despite the court’s judgment, the department has chosen to conduct an independent assessment, raising concerns about judicial precedent and tax administration.

Judicial Order Ignored

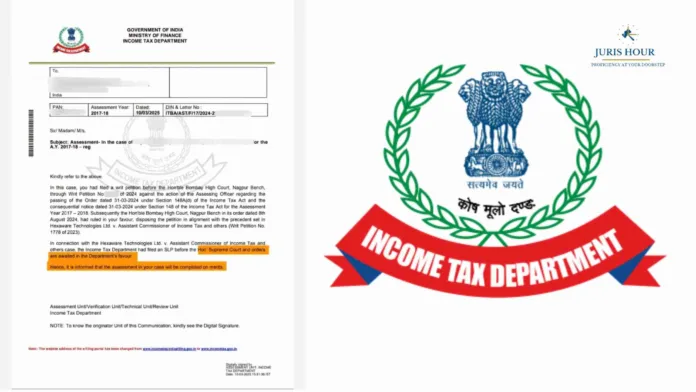

The case revolves around a writ petition filed by a taxpayer, challenging the reassessment proceedings initiated under Section 148A(d) of the Income Tax Act for the assessment year 2017-18. The Bombay High Court, in its order dated August 8, 2024, ruled in favor of the taxpayer, quashing the reassessment proceedings on the grounds of non-compliance with Section 151A of the Income Tax Act.

Despite this, the Income Tax Department has issued a notice stating that the assessment will be completed on merits, effectively sidelining the court’s decision.

Read More: Direct Tax Weekly Flashback: 16 March to 22 March 2025

Pending Supreme Court Challenge Used as Justification

A key argument put forth by the Department is its Special Leave Petition (SLP) pending before the Supreme Court in a separate case, Hexaware Technologies Ltd. v. Assistant Commissioner of Income Tax. The Department claims that the outcome of this case could favor them and is using this as justification to proceed with the assessment, even though no stay has been granted against the High Court order in question.

Legal Experts Call It ‘Contempt in the Making’

Legal professionals have raised alarms over this defiance, labeling it as a direct contempt of court. Experts argue that administrative authorities must respect and comply with judicial pronouncements unless explicitly stayed or overturned by a higher court.

“This isn’t just about one taxpayer; it’s about upholding the rule of law. The Income Tax Department’s actions set a dangerous precedent, undermining judicial authority and encouraging arbitrary actions against taxpayers,” said a leading tax litigation expert.