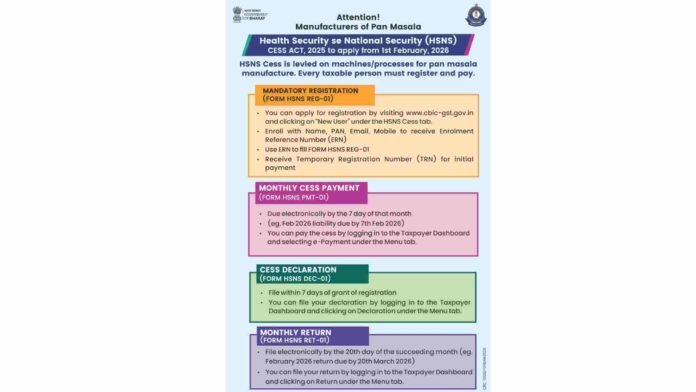

The Central Board of Indirect Taxes and Customs (CBIC) has issued an official public advisory announcing the implementation of the Health Security se National Security (HSNS) Cess Act, 2025 for manufacturers of pan masala, with effect from 1 February 2026. The cess introduces a machine- and process-based levy on pan masala manufacturing, marking a significant compliance shift for the industry.

Cess Linked to Manufacturing Machines and Processes

Under the new framework, the HSNS Cess will be levied not on production volume but on the machines and processes used for the manufacture of pan masala. CBIC has clarified that every taxable person engaged in pan masala manufacturing is mandatorily required to register and discharge the cess liability, irrespective of turnover thresholds applicable under GST.

Mandatory Registration Made Compulsory

Manufacturers are required to obtain registration under the HSNS Cess regime by filing Form HSNS REG-01. The registration process is entirely electronic and can be completed through the CBIC-GST portal. Applicants must first enrol as a new user under the HSNS Cess tab by providing basic details such as name, PAN, email and mobile number. Upon enrolment, an Enrolment Reference Number (ERN) will be generated, which must be used to submit the registration form. A Temporary Registration Number (TRN) will be issued to facilitate initial cess payment.

Monthly Cess Payment Timeline

CBIC has prescribed monthly electronic payment of HSNS Cess through Form HSNS PMT-01, which must be made by the 7th day of the relevant month. For example, cess liability for February 2026 must be paid by 7 February 2026. Payments can be made via the Taxpayer Dashboard by selecting the e-Payment option.

Declaration and Return Filing Obligations

Upon grant of registration, manufacturers must file a cess declaration in Form HSNS DEC-01 within seven days. Thereafter, a monthly return in Form HSNS RET-01 must be filed electronically by the 20th day of the succeeding month. For instance, the return for February 2026 will be due by 20 March 2026.

Legal Backing and Notifications

The CBIC advisory refers to Department of Revenue notification S.O. 6153(E) dated 31 December 2025 and Notification No. 01/2026-HSNS Cess dated 1 January 2026, which together operationalise the cess framework and prescribe procedural compliance.

Read More: MCA to set up 3 new Regional Directorates and 06 New ROCs