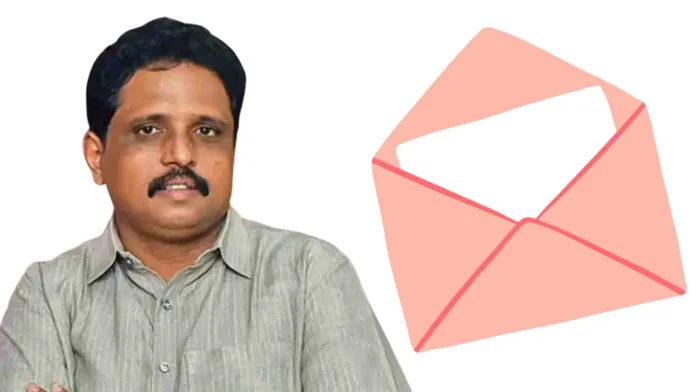

S. Venkatesan, Member of Parliament from Madurai, Tamil Nadu, has written to President Droupadi Murmu, raising serious concerns over a recent decision by the Comptroller and Auditor General (CAG) of India to invite private Chartered Accountant (CA) firms to assist in auditing public sector and local bodies.

In a strongly worded letter dated June 3, 2025, Venkatesan expressed alarm over what he described as a move that could “dilute the independence” of the constitutional body and go against the principles laid down by the Constitution of India. He called the CAG’s tender notice for private CA firms “shocking” and warned that such outsourcing of audits could lead to violations of the constitutional mandate and compromise the integrity of sensitive government information.

“The CAG is accountable only to Parliament and was given independent status under the Constitution to ensure unbiased auditing without political interference,” the letter stated.

Venkatesan argued that the involvement of private firms in audits involving thousands of crores of rupees could lead to serious consequences, including the leakage of confidential data.

Highlighting the legacy of Dr. B.R. Ambedkar in granting the CAG independent status, the MP emphasized that entrusting private firms with audit responsibilities undermines the institution’s autonomy and sets a dangerous precedent.

“The officers of the CAG department possess specialized expertise in auditing government institutions. The audit conducted by CAs is not the same as that conducted by the CAG,” Venkatesan added.

He concluded the letter by urging the President to intervene immediately and advise the CAG to withdraw the tender, emphasizing the need to preserve the distinct and independent character of the CAG in order to safeguard public finances.

The move by the CAG has sparked debate in public and political circles, with many echoing concerns over transparency, accountability, and constitutional propriety.