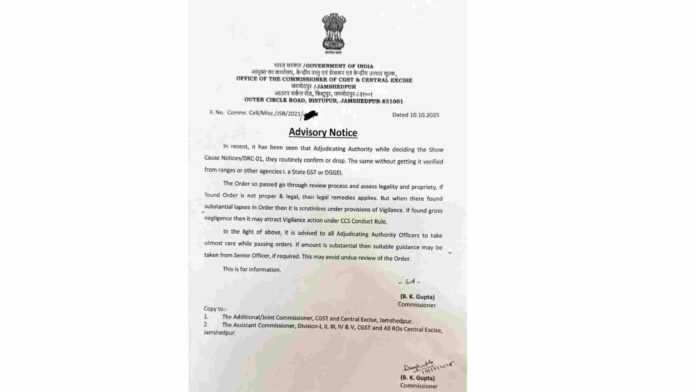

An internal “Advisory Notice” purportedly issued by the Office of the Commissioner of CGST & Central Excise, Jamshedpur, has triggered widespread concern within the tax administration and legal fraternity, with senior officers and experts questioning whether the document—if genuine—fundamentally undermines the independence of quasi-judicial adjudication under GST law.

The advisory, dated October 10, 2025, allegedly signed by B.K. Gupta, Commissioner, cautions adjudicating authorities against confirming or dropping GST show cause notices without verification from ranges or other agencies such as State GST or DGGI. More controversially, it warns that “substantial lapses” in adjudication orders may invite vigilance scrutiny and even action under the CCS Conduct Rules for gross negligence.

What the Advisory States?

The advisory claims that it has been “noticed” that adjudicating authorities routinely decide Show Cause Notices (including DRC-01 proceedings) without cross-verification from field formations or investigative agencies. It further states:

- Orders passed are subject to review for legality and propriety

- Where substantial lapses are found, such orders may be examined under vigilance provisions

- In cases of gross negligence, officers may face disciplinary action

- Adjudicators are advised to seek guidance from senior officers in substantial amount cases to avoid undue review

While framed as an “advisory,” critics argue that the language effectively operates as a deterrent against independent decision-making.

Core Legal Concern: Erosion of Quasi-Judicial Independence

Legal experts point out that adjudicating authorities under GST function as quasi-judicial officers, bound to decide cases independently on facts, evidence, and law. Any directive requiring them to:

- Seek prior guidance from seniors

- Verify decisions with investigating agencies

- Fear vigilance consequences for judicial errors

is prima facie inconsistent with settled constitutional principles.

The Supreme Court has repeatedly held that quasi-judicial authorities must remain insulated from executive pressure, including in Union of India v. Kamlakshi Finance Corporation Ltd., where the Court deprecated departmental interference in adjudication.

Threat of Vigilance Action: A Chilling Effect?

Particular alarm has been raised over the advisory’s reference to vigilance scrutiny for “substantial lapses.” Experts argue that:

- Errors in adjudication are correctable through statutory appeals, not vigilance

- Judicial or quasi-judicial errors do not amount to misconduct unless mala fides are established

- The threat of disciplinary action can create a chilling effect, pushing officers to mechanically confirm demands to avoid scrutiny

A former Chief Commissioner remarked that if such advisories are allowed, “the safest course for an adjudicator would be to confirm every demand, regardless of merit.”

Approval From Seniors? A Dangerous Precedent

The advisory has also sparked sarcasm and concern over the logical end-result it promotes. As one officer observed:

“Adjudicators might as well add a sentence stating that the order has prior approval of the Commissioner or Chief Commissioner.”

Such a practice, if institutionalised, would vitiate the adjudication process, exposing orders to challenge on grounds of lack of independence, bias, and external dictation.

Authenticity Under Question

As of now, there has been no official clarification from the CBIC or the Jamshedpur Commissionerate confirming or denying the advisory’s authenticity. However, the presence of official letterhead, file number, and circulation to field formations has added to the seriousness of the issue.

If the document is genuine, experts say it may invite:

- Judicial scrutiny

- Administrative review by CBIC

- Possible withdrawal or clarification to prevent misuse

Read More: IGI Airport Customs Seize Marijuana Worth ₹7.77 Crore; Two Arrested