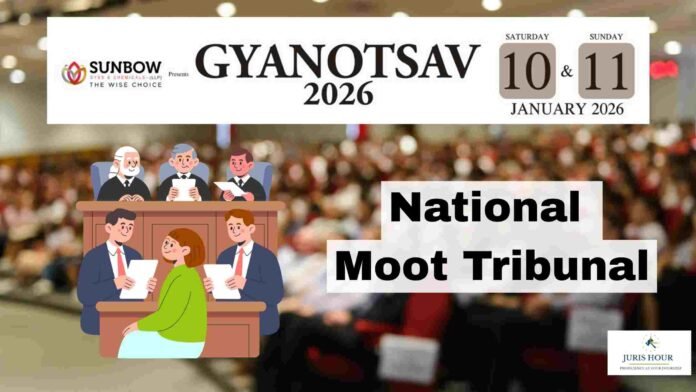

Gyanotsav 2026 which will be held at Surat (Gujarat) has announced the National Moot Tribunal Competition, offering law students, young professionals, and tax practitioners a unique opportunity to experience real-world tribunal-style advocacy under the guidance of eminent experts from the tax and legal fraternity.

The competition allows participants to compete in teams of two, encouraging collaborative research, drafting, and oral advocacy in a simulated tribunal environment. Designed with a strong practical orientation, the moot aims to bridge the gap between academic learning and professional tax litigation practice.

Registration Details and Participation Fee

The participation fee structure is as follows:

- ₹2,950 (inclusive of GST) for registrations completed on or before December 31, 2025

- ₹3,540 (inclusive of GST) for registrations completed after December 31, 2025

Interested participants can register online through the following link:

👉 https://bit.ly/gyanotsav2026

Organisers and Institutional Backing

The event is organised by the Society for Tax Analysis & Research, a body dedicated to promoting excellence in tax knowledge, litigation skills, and policy discourse. The conclave is being held in association with leading professional bodies and knowledge partners from across the tax and legal ecosystem, ensuring strong academic rigour and practical relevance.

A Platform for Future Tax Litigators

With its strong judicial presence, hands-on tribunal format, and forward-looking themes, GYANOTSAV 2026 is poised to emerge as a significant national platform for discussion, advocacy training, and capacity-building in tax litigation and appellate practice in India.

The National Moot Tribunal Competition is expected to attract participants from across the country and serve as a launchpad for aspiring tax litigators seeking exposure to tribunal proceedings, argument structuring, and judicial interaction.

Read More: Delhi HC Disposes Customs Appeal in 20 kg Gold Seizure Case Against Bullion Broker After His Death