The Goods and Services Tax Network (GSTN) has rolled out an Smarter Credit Note Handling functioning by upgrading to the Invoice Management System (IMS) on the GST portal, introducing greater flexibility and accuracy in the handling of credit notes and Input Tax Credit (ITC).

The update addresses long-standing compliance challenges faced by taxpayers where automatic ITC reversals occurred even in cases where credit was never availed or had already been reversed.

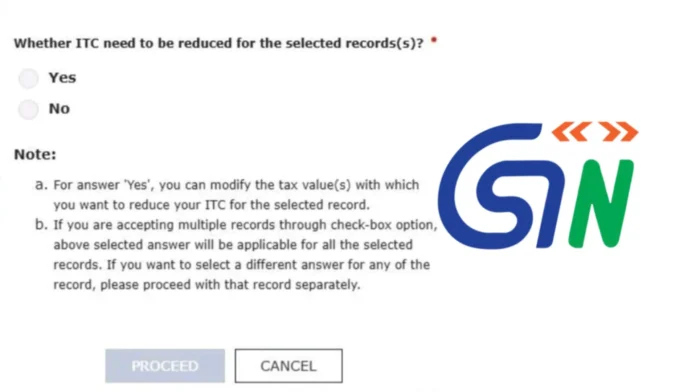

Under the updated IMS workflow, recipients of credit notes are now required to explicitly confirm whether the acceptance of a credit note should result in a reduction of ITC. Earlier, acceptance of a credit note would often trigger an automatic ITC reversal, irrespective of the actual credit position of the recipient.

The revised system now allows taxpayers to exercise an informed choice at the time of acceptance.

While accepting a credit note on the IMS dashboard, taxpayers can now select one of the following options:

If the taxpayer selects “Yes”, the ITC will be reduced. This option is intended for situations where eligible ITC was availed earlier and needs to be reversed in line with the credit note.

If the taxpayer selects “No”, the ITC will remain unchanged. This option is particularly useful where ITC has already been reversed in earlier periods or where ITC was never availed in the first place.

This flexibility ensures that ITC reversals reflect actual credit utilisation rather than system-driven assumptions.