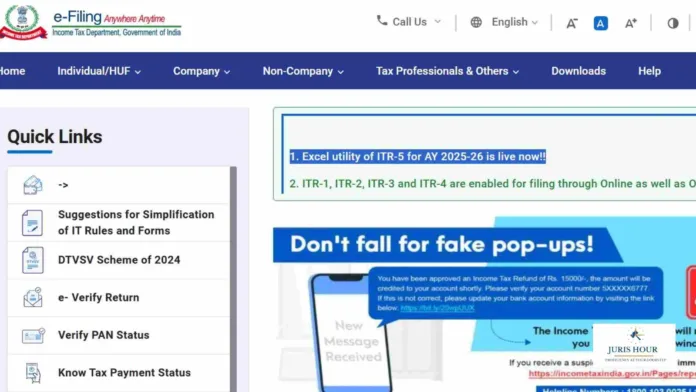

The Income Tax Department has announced that the Excel Utility for filing Income Tax Return (ITR)-5 for the Assessment Year (AY) 2025-26 is now live and available for taxpayers. The utility can be accessed through the official e-filing portal at incometax.gov.in/iec/foportal.

The ITR-5 form is applicable to firms, Limited Liability Partnerships (LLPs), Association of Persons (AOPs), Body of Individuals (BOIs), artificial juridical persons, cooperative societies, and local authorities, among others. With the launch of the Excel Utility, these entities can now prepare and file their returns in offline mode before uploading them to the portal.

In addition to ITR-5, the department has already enabled ITR-1, ITR-2, ITR-3, and ITR-4 for both online and offline filing.

The Income Tax Department has also reiterated warnings against fraudulent pop-up messages claiming tax refunds. It urged taxpayers to avoid clicking on suspicious links and to report such attempts via the phishing report page on the e-filing website.

For assistance, taxpayers can contact the department’s helpline numbers: 1800 103 0025 or 1800 419 0025.