Chartered accountants and taxpayers have taken to social media to report that the Form 26AS website is not working, the Annual Information Statement (AIS) and Taxpayer Information Summary (TIS) are failing to download, and One-Time Passwords (OTPs) are frequently delayed or not arriving at all.

In a growing concern for taxpayers and professionals across India, several critical functionalities of the Income Tax Department’s digital platforms have suffered repeated technical failures, sparking frustration ahead of the income tax return (ITR) filing deadline.

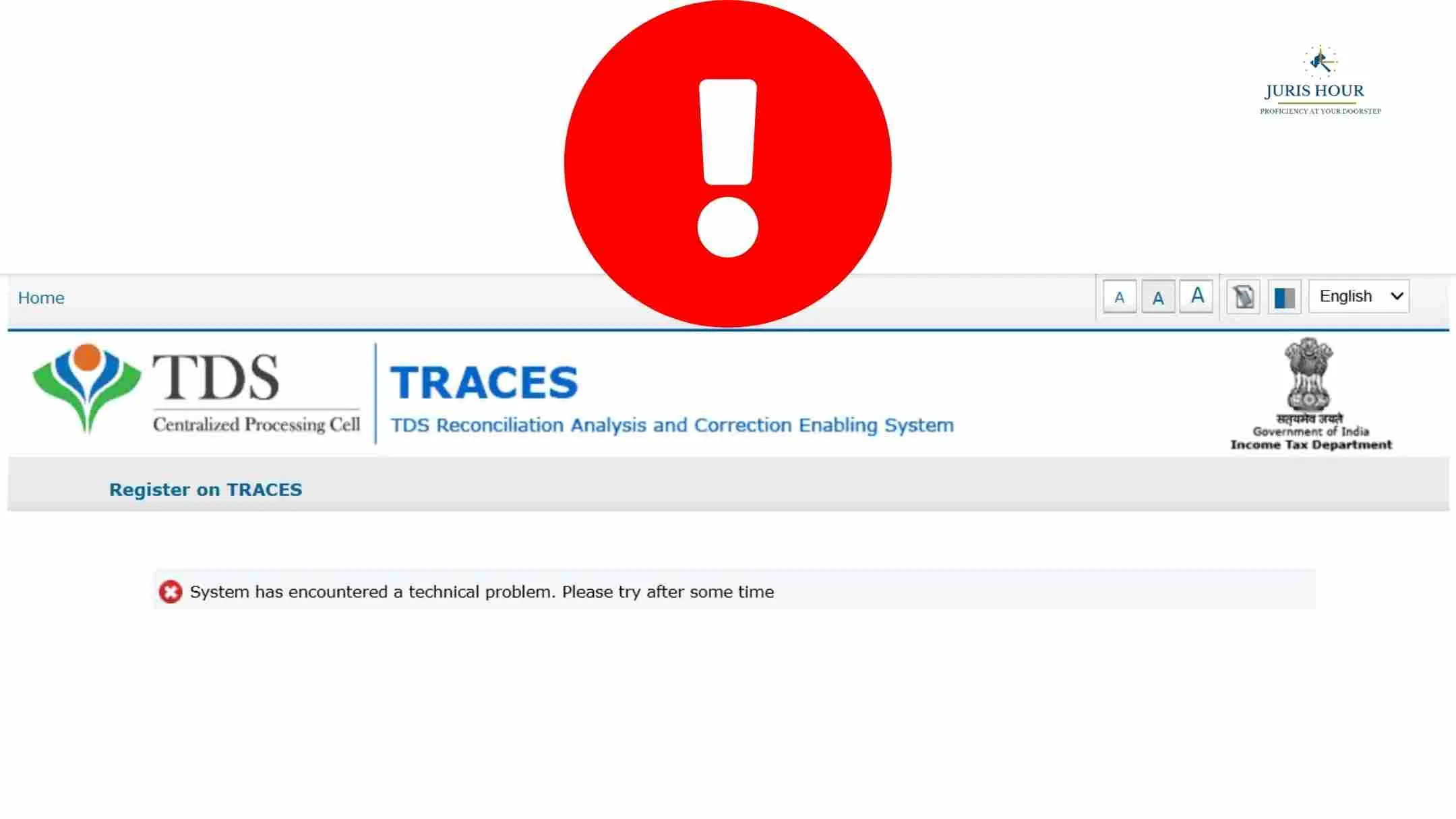

A prominent chartered accountant, CA Sumit Sharma, voiced these grievances in a widely shared tweet tagging the official handle of the Income Tax Department (@IncomeTaxIndia). Highlighting the scale of the problem, Sharma questioned how over 9 crore ITRs can be filed within just 43 days when critical portals remain dysfunctional. He also posted a screenshot showing the TRACES (TDS Reconciliation Analysis and Correction Enabling System) portal displaying the message:

“System has encountered a technical problem. Please try after some time.”

The issues have led to mounting anxiety among taxpayers and tax professionals who are already grappling with the tight filing timeline. Many users fear they could miss deadlines or face penalties despite their best efforts.

Widespread Impact Across Stakeholders

The glitches have reportedly affected:

- Downloading Form 26AS, which shows details of tax deducted at source (TDS)

- Accessing AIS and TIS statements crucial for return preparation

- Receiving OTPs required for login and verification

Several practitioners have urged the authorities to either fix the technical issues on priority or extend the filing deadline.

Department Response Awaited

As of the time of publishing, the Income Tax Department has not issued an official statement addressing these specific complaints. However, in previous years, the department has acknowledged similar outages and worked to restore services.

Call for Urgent Resolution

Given the volume of taxpayers reliant on these systems and the surge in portal traffic during the filing season, experts are stressing the need for robust digital infrastructure and contingency planning.

Tax professionals and industry associations are expected to formally escalate the matter if the problems persist in the coming days.