The Punjab and Haryana High Court has declared an arrest made by the Directorate General of GST Intelligence (DGGI) as “illegal” owing to multiple procedural violations, including prolonged detention without valid grounds, absence of CCTV surveillance, and failure to furnish mandatory documentation.

The bench of Justice Harpreet Singh Brar has warned the DGGI by stating that it is expected that such a conduct will not be repeated and that the Directorate General, Goods & Service Tax Intelligence will fully cooperate with any Court appointed officers, should such a situation present itself in the future.

Justice Harpreet Singh Brar, who presided over the matter, delivered a strongly worded judgment addressing concerns over procedural abuse and non-compliance with judicial safeguards.

The wife of the detainee filed the habeas corpus writ petition for directing DGGI to recover the husband of the petitioner, namely, Bharat Lal Garg from the illegal custody of respondents No.2 and 3 and to hand him over to the petitioner and his family members or in alternative, appoint a Warrant for this purpose.

Affidavit Summary by Sanket Kale, Additional Director General (DGGI):

- CCTV Compliance:

CCTV cameras are installed and functional at the DGGI office, Central Revenue Building, Chandigarh. They became non-functional on 30th May 2025 due to ongoing construction, which was recorded in the register. Repairs were initiated via a letter on 2nd June 2025. - Functionality Measures:

Past instances of camera outages due to technical issues were addressed swiftly. Officers are now directed to ensure CCTV functionality before recording statements. Construction work will no longer interfere with CCTV, and power switches are now secured in locked enclosures. - Record Presentation:

The required records (arrest memo, medical reports, etc.) were compiled and brought to court on 18.07.2025. Due to confusion about their mode of submission (sealed/unsealed), they weren’t shown in court. The officer was present, and the records were available. The deponent tenders an unconditional apology for the lapse. - Future Compliance:

The officer has been instructed to present original records on 30.07.2025. A prior affidavit was also filed on 18.07.2025 as per court orders. - Arrest of Bharat Lal:

The arrest followed due process and was not mechanical. No allegations of obstruction against the deponent have been made. An unconditional apology is tendered in case any departmental officer obstructed the warrant officer. - Statement Recording:

Bharat Lal’s statement was recorded at night with his consent. He never objected, nor has he retracted the statement. Officers have now been instructed to record statements during office hours under CCTV surveillance.

30-Hour Custody Without Grounds Criticized

The Court expressed concern over the detainee being kept at the DGGI zonal office for more than 30 hours — including overnight detention — despite no cognizable offence having been established at that stage. It held that such prolonged custody, absent any formal charge or urgent need, was unjustified and violative of Articles 21 and 22 of the Constitution.

“It does not stand to reason that a person would voluntarily subject himself to such treatment,” the court remarked, rejecting claims that the detention was consensual.

CCTV Surveillance Guidelines Ignored

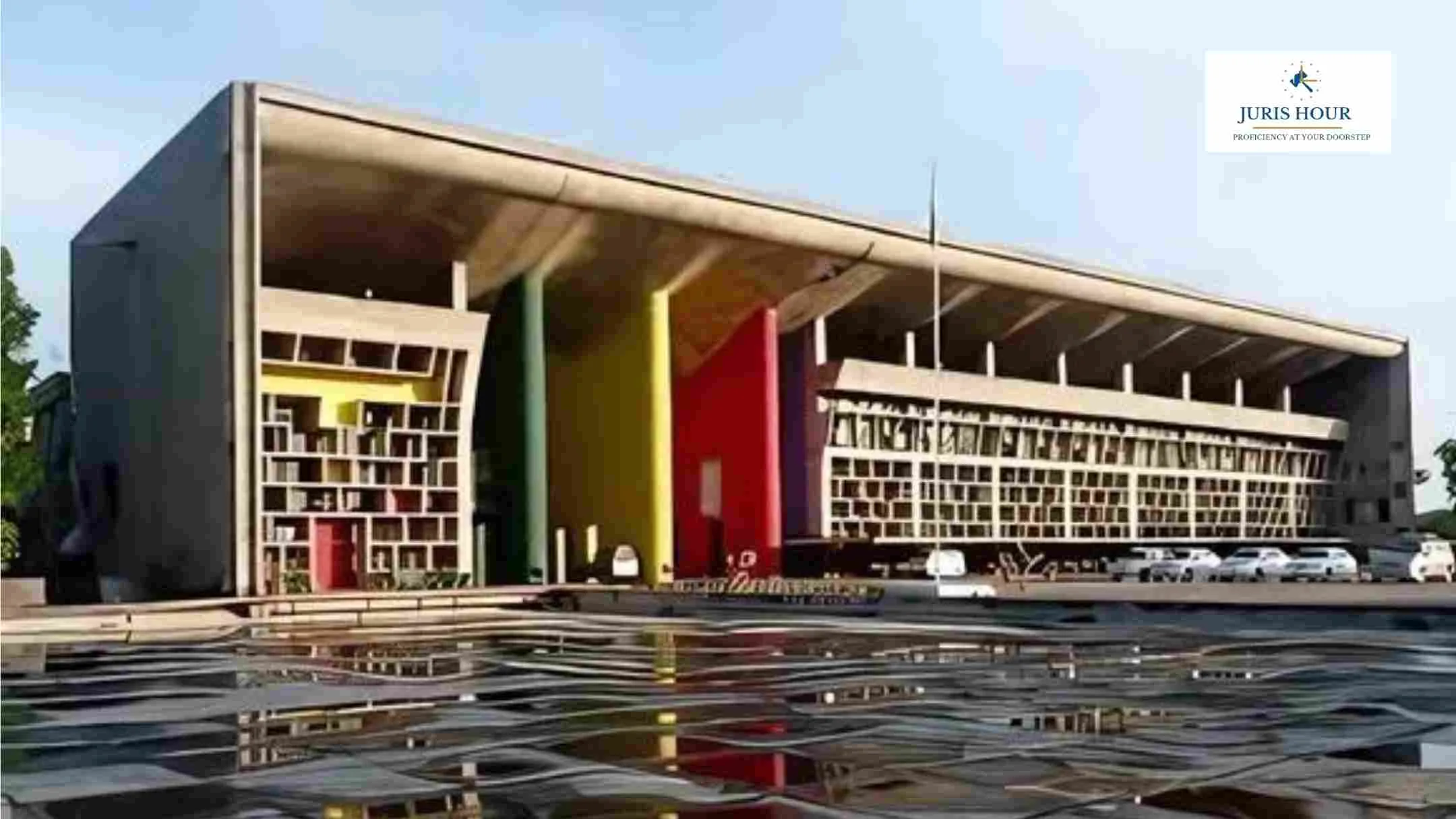

A central issue in the case was the non-functional state of CCTV cameras at the DGGI office, in violation of the Supreme Court’s ruling in Paramvir Singh Saini v. Baljit Singh (2021), which mandates continuous video surveillance in all investigating agency premises.

While an affidavit from the Additional Director General of DGGI claimed that the cameras were under repair due to construction work and that future precautions had been implemented, the court noted that their failure at the time of detention raised serious concerns about transparency and accountability.

Records Not Presented, Arrest Found ‘Mechanical’

Despite court directions, critical arrest documents — including the arrest memo, grounds of arrest, and medical examination report — were not timely presented. The DGGI attributed this to confusion during the previous hearing. The High Court accepted the apology but noted that such lapses compromise judicial oversight.

The court also found that the authorization for arrest was issued in a mechanical manner without application of mind, and notably, without a Document Identification Number (DIN), which is mandatory for all GST-related communications as per CBIC Circular No. 128/47/2019-GST.

Violation of Legal Precedents and Rights

Drawing from key judgments such as Radhika Agarwal v. Union of India, Mahesh Devchand Gala v. Union of India, and Agarwal Foundries v. Union of India, the Court reaffirmed that statements during GST investigations must be recorded during office hours; iIndividuals are entitled to record statements under CCTV surveillance; legal counsel must be allowed to remain present in visual range during questioning; and arrests must be supported by a reasoned “belief” and issued in proper legal format.

Court Orders Immediate Release

Holding that the arrest lacked legal justification and failed to follow procedural safeguards, the High Court ordered immediate release of the detainee, if not required in any other matter. The Court also emphasized that any recurrence of such conduct would warrant strict judicial scrutiny.

A Cautionary Message to Tax Authorities

This ruling serves as a sharp reminder to GST enforcement agencies to operate within constitutional and legal boundaries. The judgment not only underscores the need for procedural compliance in arrest and detention but also emphasizes the inviolability of individual rights during tax investigations.

Earlier, the Punjab & Haryana High Court has initiated contempt proceedings against senior officials of the Central Revenue Department for allegedly detaining a man unlawfully and obstructing the functioning of a court-appointed warrant officer.

Case Details

Case Title: Barkha Bansal Versus State of U.T. Chandigarh and others

Case No.: CRWP-6077-2025 (O&M)

Date: 30.07.2025

Counsel For Petitioner: Vinod Ghai, Senior Advocate

Counsel For Respondent: Satya Pal Jain, Addl. Solicitor General of India

Read More: CA Raises Alarm Over Rs. 5K Late Fee in ITR Filing Despite Deadline Extension