A technical glitch on the Income Tax Department’s e-filing portal has sparked concerns among salaried taxpayers attempting to file their Income Tax Returns (ITR) for the Assessment Year 2025–26. Several users have flagged that the option to claim House Rent Allowance (HRA) exemption under Section 10(13A) is currently disabled in the ITR-2 form, despite HRA being included in their gross salary figures.

Taxpayer’s Tweet Goes Viral

The issue gained traction after a taxpayer, Rakesh Swami, took to social media platform X (formerly Twitter), tagging Finance Minister Nirmala Sitharaman, @IncomeTaxIndia, and the Ministry of Finance. Swami’s tweet read:

“Honourable FM @nsitharaman ji

The genuine taxpayers are facing difficulties in filing ITR.

Option to enter HRA exemption is disabled in the ITR-2 form despite gross salary including HRA as a component.

Please help on priority ✨🎉🙏”

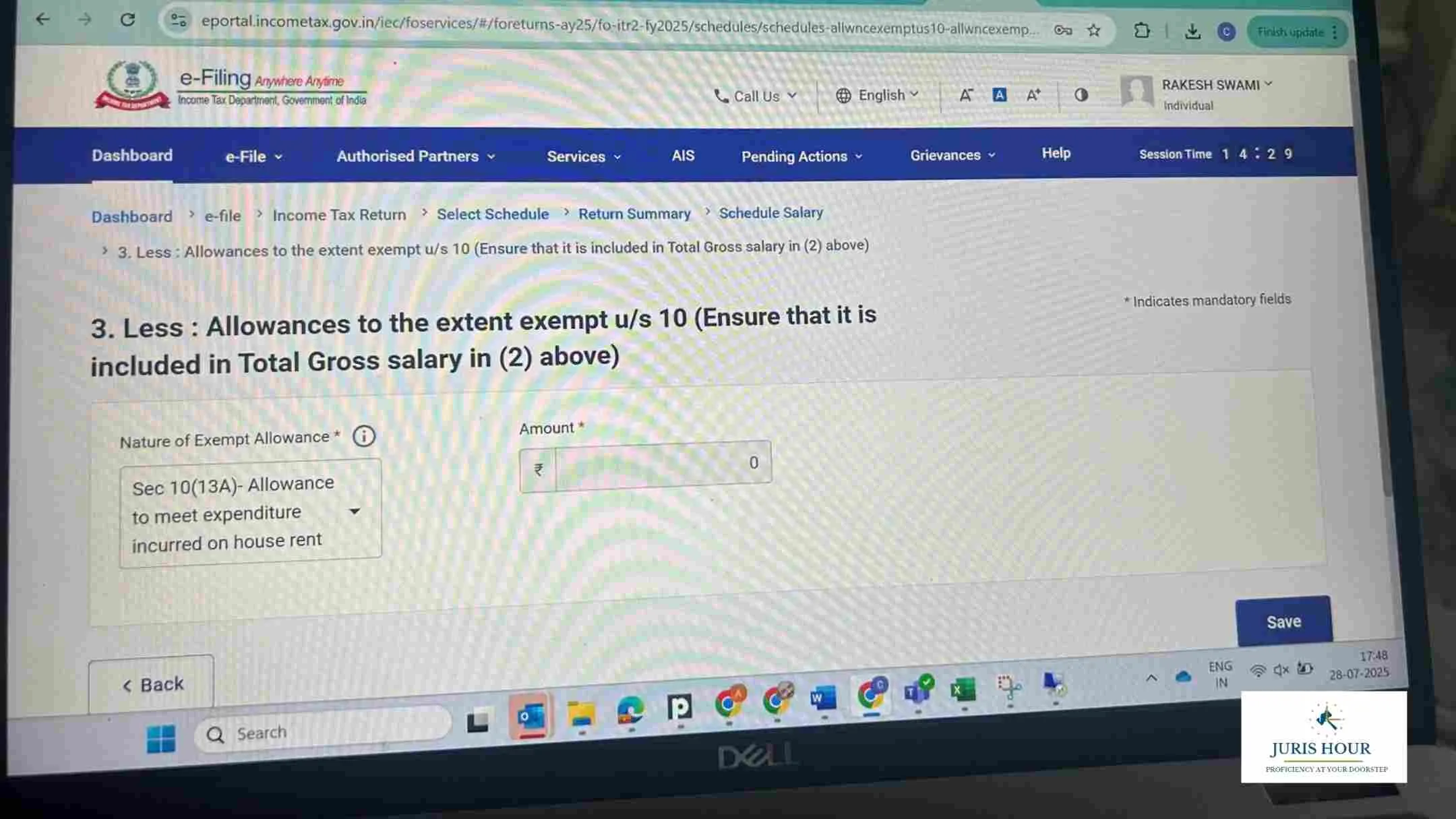

He also shared a screenshot from the official income tax e-filing portal clearly showing the HRA exemption section greyed out or non-functional, with a value of “0” entered and no ability to modify it.

Section 10(13A) — A Common Exemption

House Rent Allowance (HRA) exemption is a crucial relief for millions of salaried employees living in rented accommodations. It allows deduction of the least of the following from taxable income:

- Actual HRA received,

- Rent paid minus 10% of salary,

- 50% of salary in metro cities / 40% in others.

Its absence or inaccessibility in the ITR form could lead to inflated taxable income and higher tax outgo.

Professionals React

Tax practitioners and chartered accountants have also begun flagging the issue as widespread, urging the Central Board of Direct Taxes (CBDT) to provide an immediate resolution. Many suggest the glitch could be tied to either a portal update or a validation error in the backend.

“Filing season is peaking and such issues create unnecessary anxiety and confusion among genuine filers,” said Ruchir Bhatia, a Delhi-based tax consultant. “The HRA exemption is not a luxury; it’s a legal relief every salaried employee is entitled to.”

Potential Implications

If not resolved soon, affected taxpayers may either:

- Delay filing returns, risking penalties for late filing, or

- Submit incorrect returns, requiring future rectification or revised returns.

Moreover, this may disproportionately affect middle-class taxpayers who rely heavily on such exemptions for tax savings.

What the Government Should Do

Experts urge the Income Tax Department to:

- Immediately fix the form validation for ITR-2;

- Release a public clarification or FAQ via the official portal or social media;

- Extend the due date for filing ITR if the glitch persists.

Way Forward

While the government has taken strides in digitising tax administration, recurring glitches on the portal highlight the need for robust testing before deployment. Until then, taxpayers are advised to document their grievances via the official Grievances tab on the portal or contact the helpline.

Read More: GST Data Leak Exposes Grave Security Lapses: Confidential Filings Allegedly Sold Online