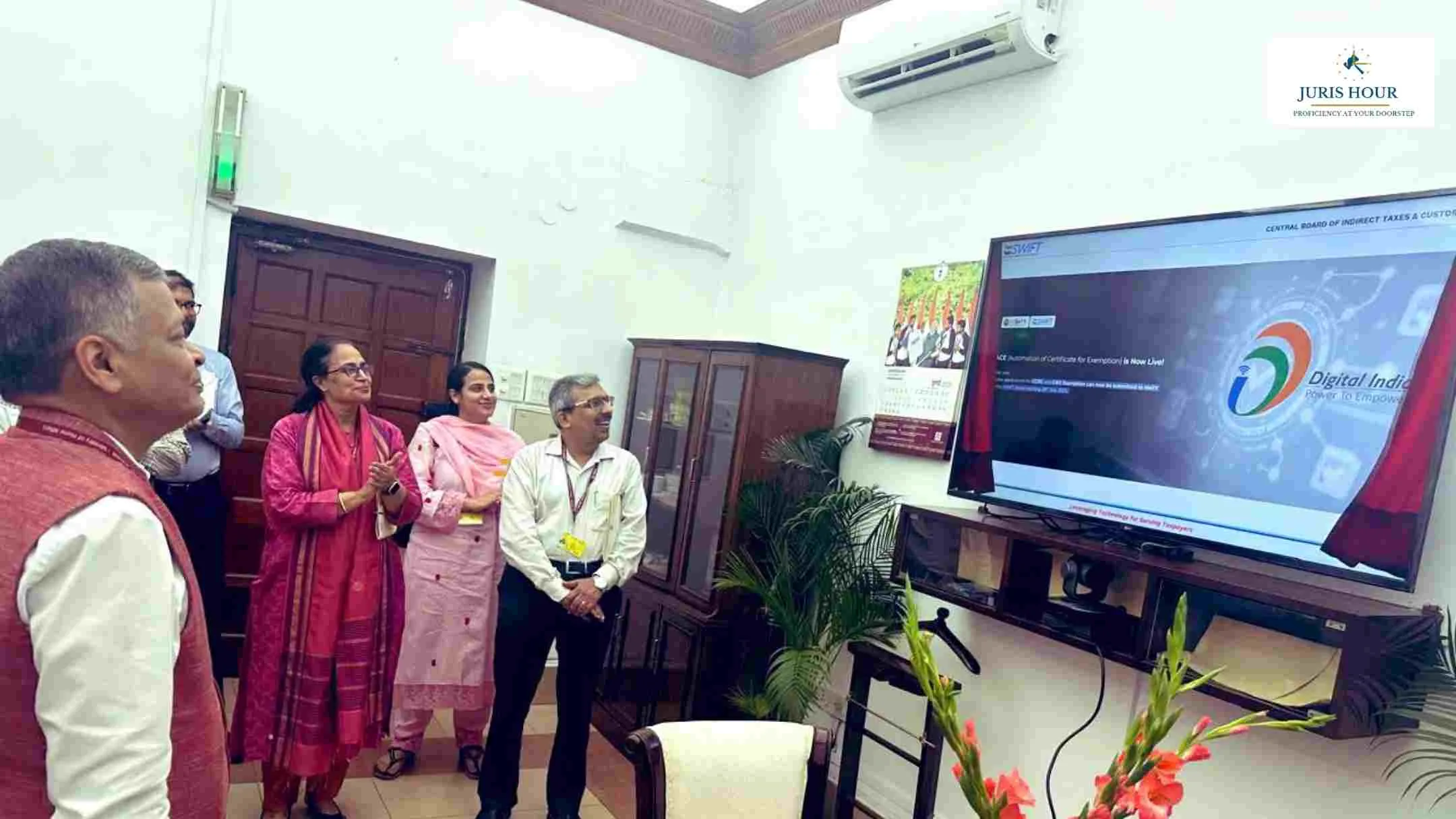

In a major digital push for India’s trade facilitation and #EaseOfDoingBusiness goals, the Central Board of Indirect Taxes and Customs (CBIC) has launched a revolutionary digital platform – the Automation of Certificate of Exemption (ACE) under SWIFT 2.0. This landmark initiative was officially launched by Sh. Yogendra Garg, Member (IT), CBIC, signaling a bold step towards seamless, paperless EXIM (export-import) operations.

With the ACE system now live, importers and exporters can apply online for concessional customs duty and CRO exemption certificates issued by the Ministry of Electronics and Information Technology (MeitY). This integration is expected to significantly reduce time, cost, and bureaucratic red tape, which previously hampered trade efficiency.

100% Online Process: No more physical submissions or running from pillar to post. The entire exemption process is now a few clicks away.

Real-Time Integration with MeitY: SWIFT Portal will now directly handle certificate validation and exemption requests.

Trade Transparency and Speed: Faster clearances, increased compliance, and improved governance.

The launch ceremony witnessed enthusiastic participation from senior officials, with a live demonstration underscoring the platform’s user-friendly interface and real-time processing capabilities. Visuals shared by CBIC show officials celebrating this digital leap, with the portal already accepting submissions.

Experts are hailing this as a watershed moment in India’s digital trade ecosystem. By eliminating manual intervention and ensuring swift document processing, SWIFT 2.0 is set to empower businesses, especially MSMEs, to trade with greater ease and global competitiveness.

This development aligns perfectly with the Government’s broader vision of a Digital India and reducing the compliance burden on businesses.

Just Click. Apply. And Clear – the new mantra for India’s trade facilitation journey.

Read More: GSTAT Procedural Timelines: Guide for Taxpayers, Dept