A Reddit post by an exasperated Indian salaried worker has gone viral, tapping into widespread frustration over perceived tax inequality between the formal and informal sectors.

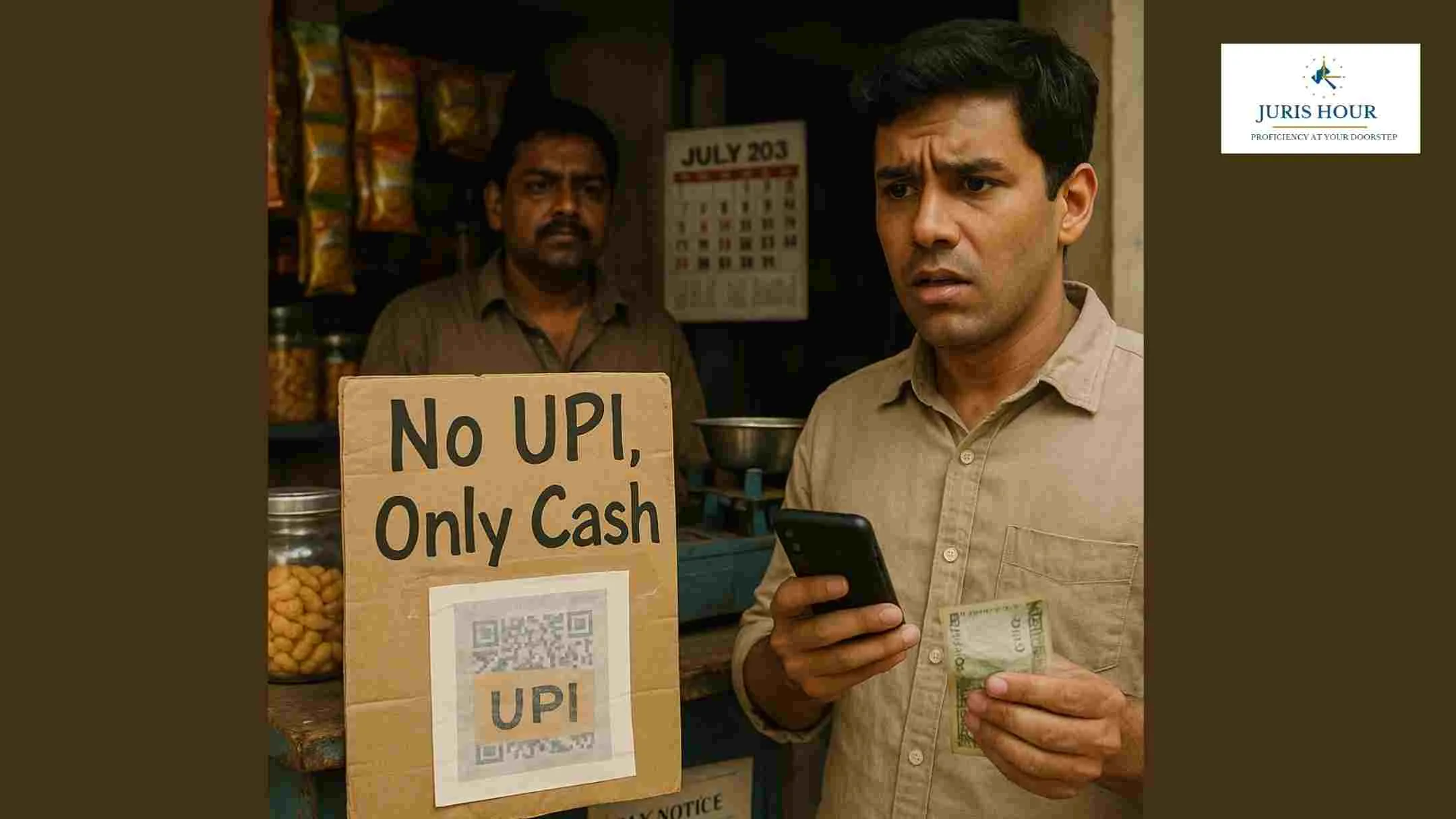

The post, which has generated intense discussion online, criticizes small vendors who are increasingly refusing Unified Payments Interface (UPI) transactions to avoid tax scrutiny.

The anonymous user’s post reflects the growing anger among the middle class, who say they face stringent tax compliance while large sections of the informal economy escape oversight. “We are taxed at every step — income, savings, road use, fuel, even when claiming deductions for medical expenses,” the user wrote. “Meanwhile, vendors dodge tax by demanding cash.”

The tipping point, the post claims, has been the wave of “No UPI, Only Cash” signs cropping up in Bengaluru, a city known for its tech-savvy population. This shift is reportedly driven by small traders’ fears of attracting GST notices and eviction threats due to digital transaction trails.

In a stark message, the Redditor added, “Being poor doesn’t exempt you from paying taxes. If you refuse UPI, we will refuse to buy.” They called on fellow middle-class Indians not to protest — which could put jobs or reputations at risk — but instead to push for accountability through everyday financial decisions. “Refuse cash payments. Demand UPI. Everyone must contribute to the tax system.”

The sentiment has struck a nerve at a time when reports suggest thousands of Bengaluru’s unregistered vendors have received GST notices, some facing hefty demands running into several lakhs of rupees. Many vendors now cite concerns over transaction limits, digital trails, and surprise audits as reasons to avoid UPI.

The post has reignited a national conversation around tax fairness, compliance, and the digital divide — highlighting the ongoing tension between India’s tightly monitored formal workforce and its largely unregulated informal sector.

Read More: Supreme Court Orders CBI Probe into Custodial Torture in Kupwara, Awards Rs. 50 Lakh Compensation