The Income Tax Department has officially announced that the Excel Utilities for Income Tax Return (ITR) forms ITR-2 and ITR-3 for the Assessment Year (AY) 2025-26 are now live and available for use.

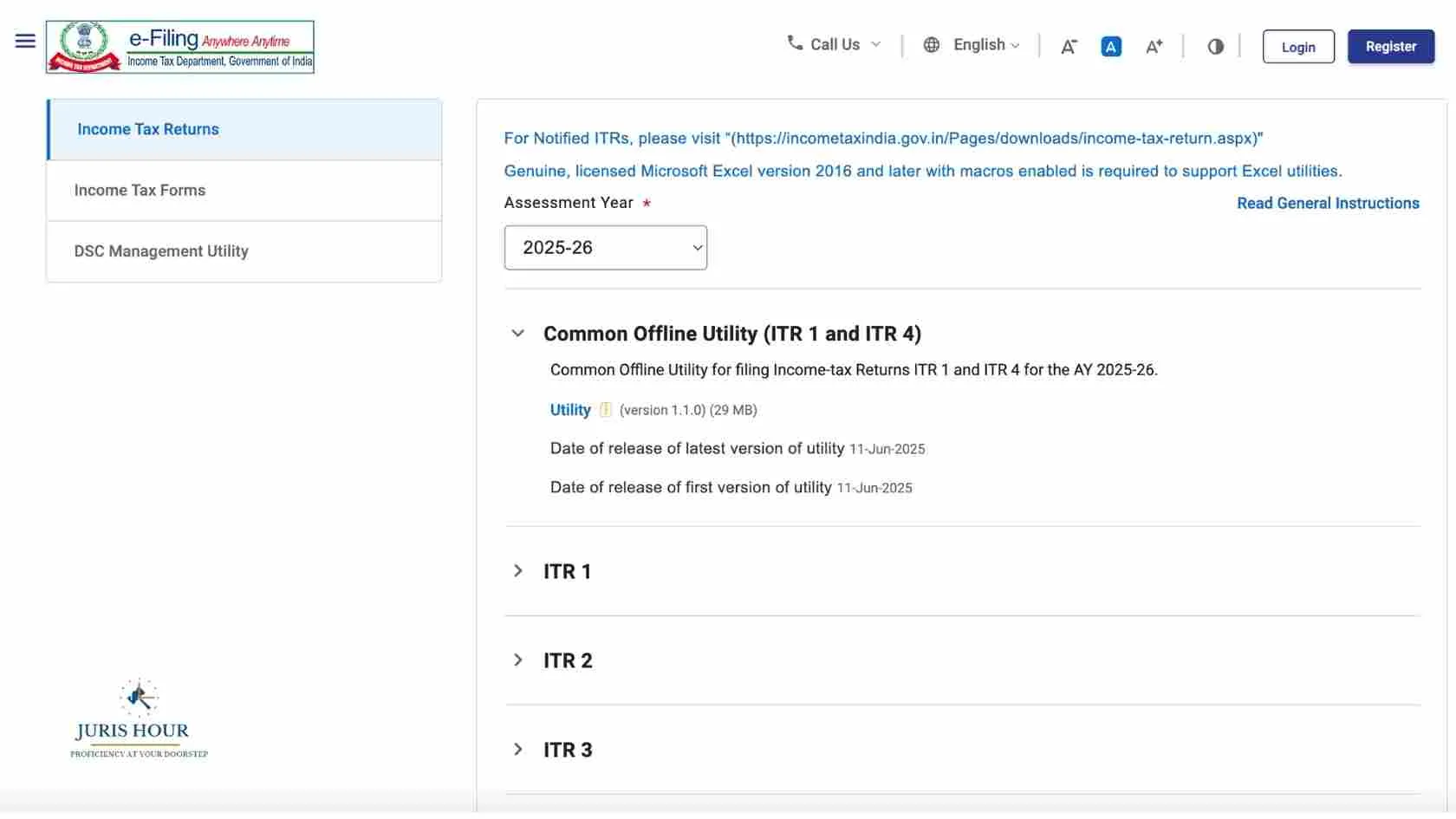

The utilities can be accessed and downloaded from the official Income Tax portal at incometax.gov.in.

The announcement was made through the official X (formerly Twitter) handle of the Income Tax Department, urging taxpayers to begin filing their returns using the newly released Excel-based formats.

This move is expected to ease the return filing process for professionals, salaried individuals with capital gains, and those with income from business or profession.

Excel Utilities Released: ITR-2 is applicable for individuals and HUFs not having income from business or profession, while ITR-3 is applicable to individuals and HUFs having income from business or profession.

User-Friendly Interface: These Excel-based utilities allow offline data entry, validation, and file generation, which can be later uploaded on the e-filing portal.

Security Alert: The Income Tax Department also issued a scam alert warning taxpayers against fake pop-ups and fraudulent calls. Users are advised not to share sensitive data unless on the official portal.

The portal also now facilitates submission of Form ITR-B for taxpayers who have received notices under Section 15BBC. This form can be filed via the e-Proceeding tab on the portal.

Taxpayers are encouraged to avoid the last-minute rush and file their returns well before the deadline. For assistance, users can explore help guides and FAQs provided on the portal or reach out through official helplines.

Read More: Kerala High Court Grants Anticipatory Bail to ED Officer in Rs. 2 Crore Bribery Case