Top Stories - Page 10

Rajasthan HC Denies Bail to Kingpin in Rs. 1800 Cr Fake Scrap Racket;...

The Rajasthan High Court, Jaipur Bench has refused bail to the kingpin in Rs. 1800 Cr fake scrap racket and Directorate...

GST Fraud of Rs. 23.48 Crore Unearthed by CGST Gautam Buddha Nagar;...

In a major crackdown on tax evasion, the Central Goods and Services Tax (CGST) Commissionerate, Gautam Buddha Nagar,...

Engineering, Design Services Exported To Foreign Group/Sister Company...

The Bombay High Court while allowing the Input Tax Credit (ITC) held that the engineering, design services exported to...

Advisory to file pending returns before expiry of three years: GSTN

The Goods and Service Tax Network (GSTN) has issued the advisory to file pending returns before expiry of three years. ...

Bridging the Appellate Gap: GST Recovery Protocols After Dismissal of...

The article “Bridging the Appellate Gap: GST Recovery Protocols After Dismissal of First Appeal” has been authored by...

Service Tax Not Leviable On Royalty: CESTAT

The Delhi Bench of Customs, Excise and Service Tax Appellate Tribunal (CESTAT) has held that service tax is not leviable...

Himachal Pradesh High Court Quashes NFAC Order, Slams Anarchy From...

The Himachal Pradesh High Court has quashed the order passed by National Faceless Appeal Centre (NFAC) and slammed ...

Delhi High Court Bar Association Condemns ED's Summons to Senior...

The Delhi High Court Bar Association (DHCBA) has strongly condemned the Enforcement Directorate’s (ED) reported attempt...

MCA Penalises CA for Violating Auditor Resignation Norms Under...

The Ministry of Corporate Affairs (MCA) has penalised a Chartered Accountant for non-compliance with auditor resignation...

Justice Yashwant Varma Refuses to Resign, Citing ‘Unjust’ Process in...

In a rare and defiant stance against what he described as a “fundamentally unjust” process, Justice Yashwant Varma has...

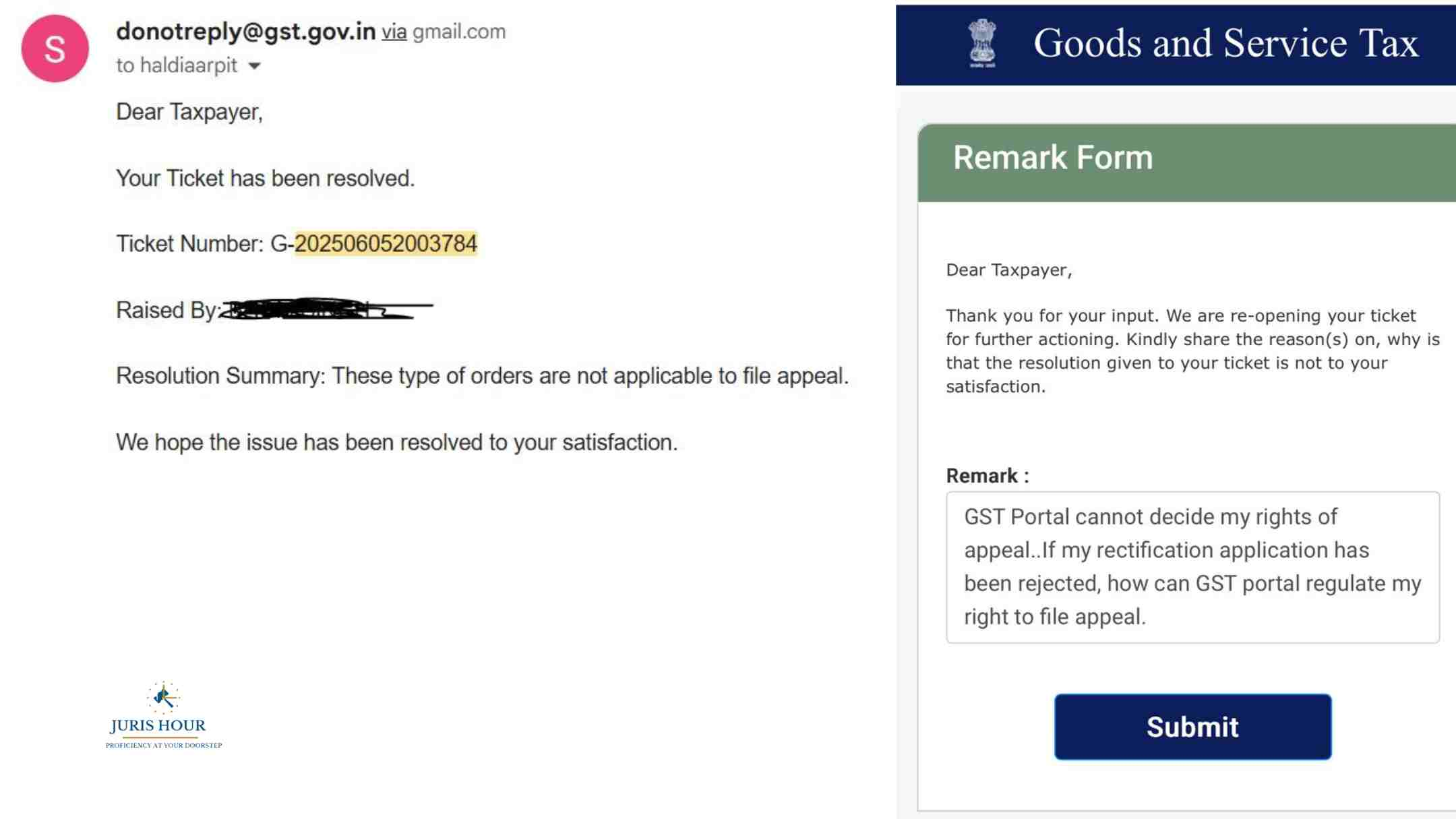

Taxpayer Denied Statutory Right to Appeal Due to GST Portal Glitch:...

A recent incident has sparked concern among tax professionals and taxpayers alike, after a registered taxpayer was...

AO Must Know Reassessment Notice Have Serious Civil Or Evil...

The Himachal Pradesh High Court has held that the Assessing Officer (AO) must know reassessment notice has serious civil...