You Searched For "Tax"

ICMAI Seeks Inclusion of Cost Accountants in "Accountant" Definition...

The Institute of Cost Accountants of India (ICMAI) has submitted a memorandum to the Select Committee of Lok Sabha,...

GST Applicable On Supply Of Mobile Veterinary Unit Personnel On...

The West Bengal Authority of Advance Ruling (AAR) has ruled that no GST is payable on supply of mobile veterinary unit...

GST Exemption On Milling Of Food Grains For PDS If Value Of Goods Does...

The West Bengal Authority of Advance Ruling (AAR) has ruled that Goods and Service Tax (GST) exemption is available on...

No GST On Supply Of Processed Sea Food In ‘Industrial Pack - Not For...

The West Bengal Authority of Advance Ruling (AAR) has ruled that no goods and service tax (GST) is payable on supply of...

No GST On Reimbursement Of Electricity Charges On Actual Basis: AAR

The West Bengal Authority of Advance Ruling (AAR) has ruled that goods and service tax (GST) is not payable on...

GST Payable On Reimbursement Of Municipal Property Tax By...

The West Bengal Authority of Advance Ruling (AAR) has ruled that Goods and Service Tax (GST) is payable on reimbursement...

GST Registration Must For Liquidator, Rules AAR: Know Why

The West Bengal Authority of Advance Ruling (AAR) has ruled that the GST registration is must for liquidator as any sale...

PVC Raincoats Attract 18% GST; Not Classified as Textile Apparel,...

The West Bengal Bench of Authority of Advance Ruling (AAR) has ruled that 18% GST is payable on supply of PVC raincoat. ...

Rs.1.42 Crores Excise Duty Against Zarda Factory: Delhi High Court...

The Delhi High Court has dismissed the department's appeal demanding Rs.1.42 Crores Excise Duty from a Zarda Factory...

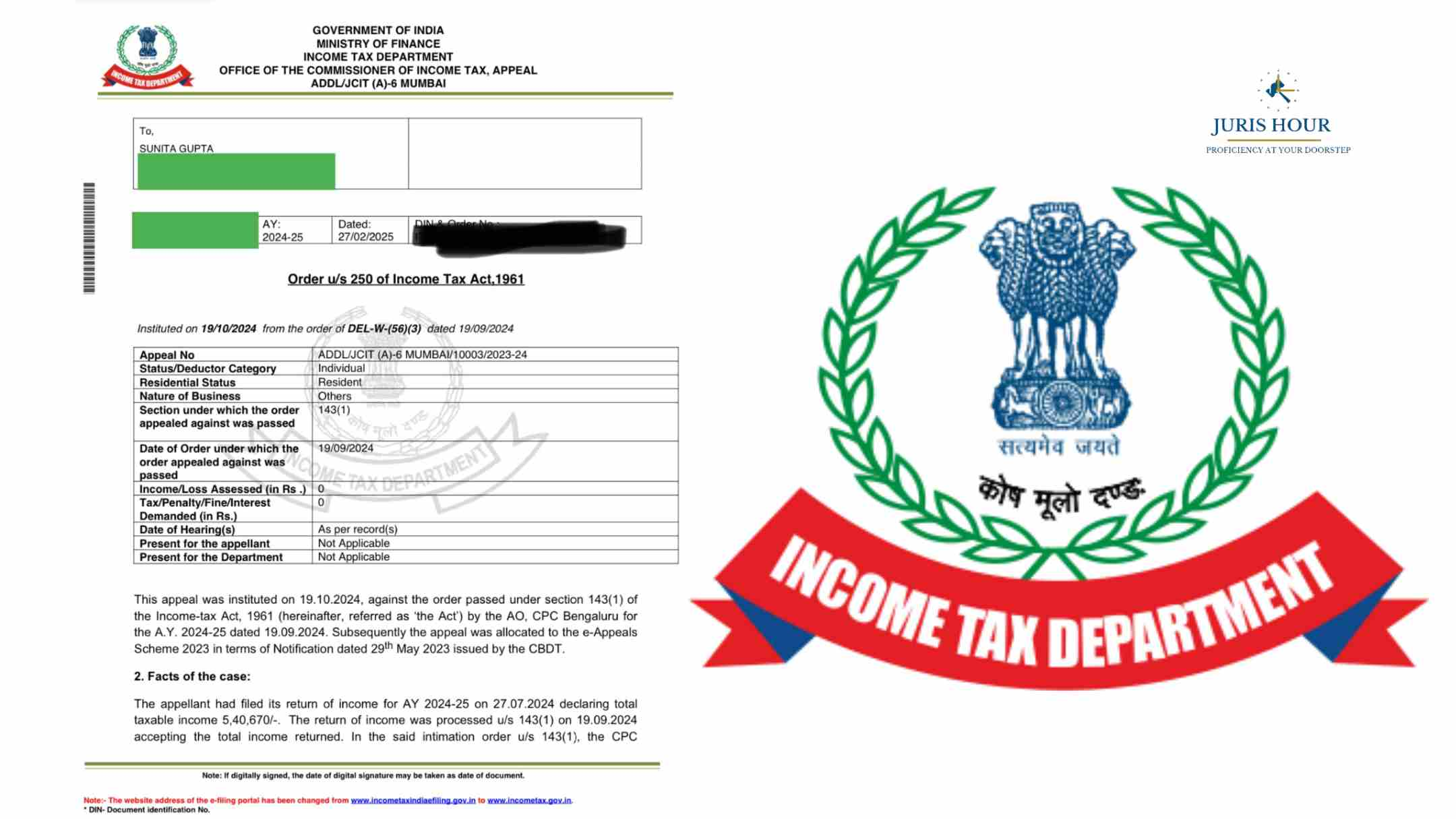

INCOME TAX APPEALS | CIT(A) Corrects Action Of CPC By Allowing S. 87A...

The Commissioner of Income Tax (Appeals) while correcting the action of the Central Processing Unit (CPC) held that...

Standard Chartered Bank Constraint To File TRAN-01 On Other State's...

The Supreme Court has dismissed the Special Leave Petition (SLP) filed by the department over TRAN-01 filing via other...

Two-Tier Satisfaction Of AO Must For Reassessment: Delhi High Court

The Delhi High Court has clarified that requirement for Two-Tier Satisfaction of the Assessing officer of both the...