You Searched For "Income Tax"

Direct Tax Weekly Flashback: 23 To 29 March 2025

Direct Tax Weekly Flashback from 23 to 29 March 2025. Table of ContentsSupreme Court Income Tax Demands After...

Taxpayer Data Misuse Allegations: CBI Registers Case Against Income...

The Central Bureau of Investigation (CBI) has registered a case against six individuals, including five officials of the...

CBDT Notifies New Disclosure Rules for MSME Payments, Share Buybacks,...

The Central Board of Direct Taxes (CBDT) has introduced significant amendments to tax audit reporting requirements under...

New Definition of "Specified Premises" For Hotel Accommodation...

The Central Board of Indirect Taxes and Customs (CBIC) has issued the Frequently Asked Questions (FAQs) on ‘restaurant...

Juice Seller Shocked by Rs 7.79 Crore Income Tax Notice

A small-time juice seller in Aligarh’s district court compound was left in shock after allegedly receiving an income tax...

Govt. Introduces New Legal Provisions to Track Digital Assets in...

The Indian government has proposed new legal provisions under the Income Tax Bill, 2025 to enhance the tracking and...

Redevelopment Flat Value Not To Be Taxed U/s 56(2)(X) Of Income Tax...

The Mumbai Bench of Income Tax Appellate Tribunal (ITAT) has ruled that redevelopment flat value is not taxable as...

Finance Bill 2025 Introduces New Provision Enabling Cross-Verification...

The Finance Bill 2025 has introduced significant amendments to Section 143(1) of the Income-tax Act, 1961, refining the...

Finance Bill, 2025: Amendments In Chapter XIV-B Of Income-Tax Act 1961

The Finance Bill, 2025 has notified the amendment in the Chapter XIV-B of the Income-tax Act, 1961 and has redefined...

Finance Bill 2025: Government Amends Definition of 'Capital Asset'

The Finance Bill 2025 has introduced a significant amendment to the definition of “capital asset” under Section 2(14) of...

Income Tax Demands After Resolution Plan Approval Is Invalid: Supreme...

The Supreme Court has declared the income tax demands raised after the approval of resolution plan (RP) by the National...

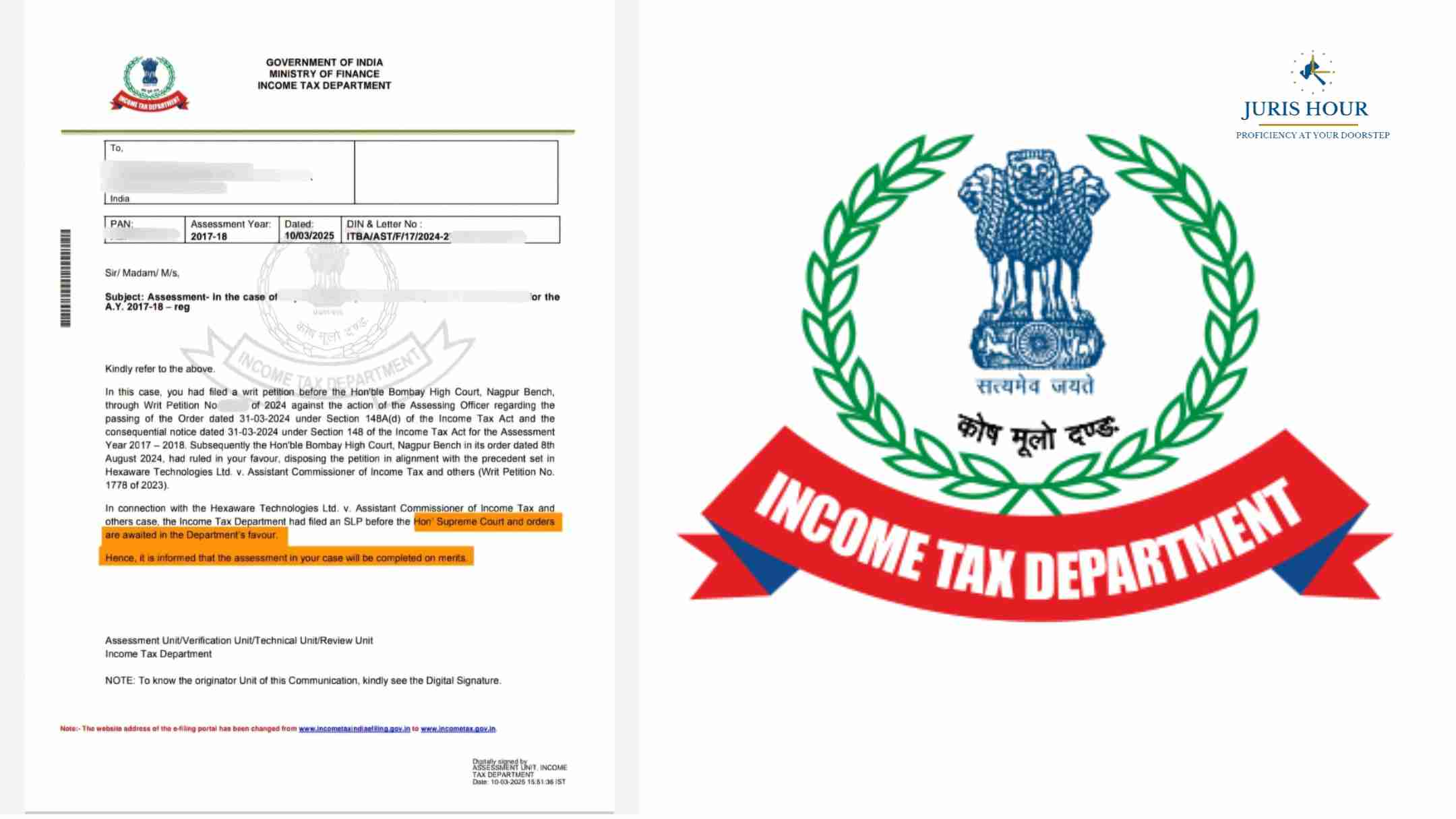

Income Tax Dept. Bypasses Bombay High Court Ruling In Hexaware Case,...

The Income Tax Department has disregarded the Bombay High Court's ruling in the Hexaware Technologies case and proceeded...