Tax professionals have flagged critical issues with the GSTN portal’s latest GSTR-1 filing interface, drawing attention to what they call an “unreasonable insistence” on providing B2B-related HSN code details even when no such supplies exist for the relevant tax period.

Key Concerns Raised by the Tax Community

The concerns highlighted include:

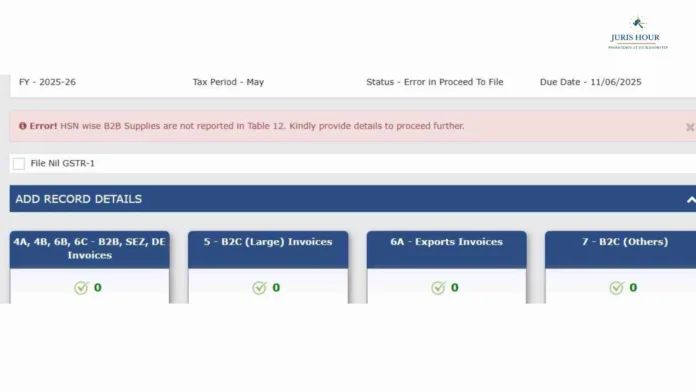

- B2B Requirement Despite Only B2C Supplies: Professionals report that even when only B2C transactions exist in a given month, the GST portal mandates the input of B2B HSN codes in Table 12, causing compliance challenges.

- NIL Supply Scenario Still Triggers Portal Validation: In cases where earlier B2B supplies were amended and offset by an equal reduction in B2C supplies—effectively resulting in no net supply—the portal still insists on B2B HSN entries.

Professionals are urging CBIC to acknowledge these technical inconsistencies, issue an advisory for clarity, and waive late fees arising due to portal-induced delays. “It is not possible to raise grievances in each and every specific case,” the post emphasized.

CBIC’s Clarification

In response, the Central Board of Indirect Taxes and Customs (CBIC) issued a detailed statement referencing Notification No. 12/2017-Central Tax (as amended). CBIC clarified that:

HSN Code Optional for Small B2C Suppliers: For registered persons with an aggregate turnover of up to ₹5 crore in the previous financial year, HSN code disclosure for B2C supplies is optional.

Table 12 Bifurcation Effective May 1, 2025: Following the GSTN advisory dated May 1, Table 12 of GSTR-1/1A is now divided into two tabs—“B2B Supplies” and “B2C Supplies”. For B2B supplies, HSN details are mandatory, while for B2C, the system allows the taxpayer to leave the HSN summary blank, provided turnover conditions are met.

System Validation and Flexibility: Although validations are in place to match HSN values across tables, the system allows flexibility for eligible small taxpayers, and the B2C HSN tab is not mandatory in such cases.

Read More: GSTN Issues Advisory For Taxpayers Facing Difficulties In Filing Amnesty Applications On GST portal