The Goods and Services Tax Network (GSTN) today announced that the option to file the Letter of Undertaking (LUT) for the financial year 2026-27 has now been enabled on the GST portal. Taxpayers engaged in export of goods or services can now complete and submit Form GST RFD-11 for the upcoming financial year, marking an important early compliance step for exporters across the country.

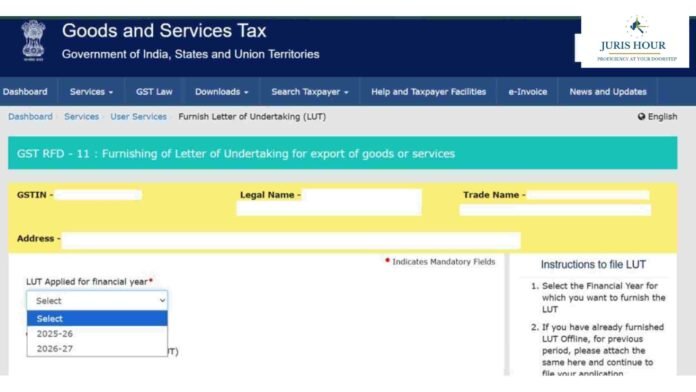

The updated functionality—visible in the “Furnish Letter of Undertaking (LUT)” section of the GST portal—displays the financial year dropdown with 2026-27 as a selectable option alongside the existing 2025-26 period, allowing taxpayers to file or renew LUT in advance of the new fiscal year.

With global supply chains and export businesses accelerating operations, the move is widely expected to smooth compliance and reduce administrative delays for units making zero-rated supplies under LUT without payment of IGST.

LUTs are required under GST law for exporters and suppliers to Special Economic Zones (SEZ) who intend to make zero-rated supplies without payment of integrated GST. Without a valid LUT for the relevant financial year, taxpayers must pay IGST on exports and later claim a refund—a process that can extend working capital cycles.

Industry tax professionals have welcomed the early rollout of the LUT filing window, saying it gives exporters more time to prepare documentation and submit their applications ahead of the fiscal year starting on April 1, 2026.

Under the updated GST portal interface, taxpayers can also attach their previously furnished LUT (if filed offline for earlier periods) and proceed with the online declaration. Once filed, the system provides an Acknowledgment Reference Number (ARN) confirming receipt of the application.

Officials emphasize that LUTs must be filed before initiating zero-rated supplies under the concession to avoid additional compliance burdens. The portal continues to support digital signing through DSC or EVC methods.

The GSTN rollout mirrors feedback from industry stakeholders calling for more proactive compliance support ahead of the new financial cycle. Exporters are advised to file or renew their LUTs at the earliest to ensure uninterrupted operations.

Read More: Gold and Silver FoFs vs ETFs