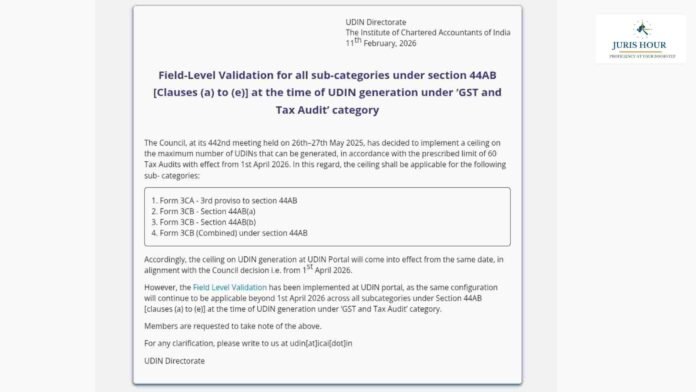

The Institute of Chartered Accountants of India (ICAI) has announced the implementation of field-level validation for all sub-categories under Section 44AB at the time of UDIN generation in the ‘GST and Tax Audit’ category. The new framework will take effect from April 1, 2026.

The announcement, issued by the UDIN Directorate on February 11, 2026, follows a decision taken at the 442nd Council Meeting of ICAI held on May 26–27, 2025. The Council resolved to implement a ceiling on the maximum number of Unique Document Identification Numbers (UDINs) that can be generated for tax audits, in accordance with the prescribed limit of 60 tax audits per member.

60 Tax Audit Ceiling to Be Enforced

As per the notification, a ceiling of 60 tax audits will be strictly enforced through the UDIN portal from April 1, 2026. The cap will apply to the following sub-categories under Section 44AB:

- Form 3CA – 3rd Proviso to Section 44AB

- Form 3CB – Section 44AB(a)

- Form 3CB – Section 44AB(b)

- Form 3CB (Combined) under Section 44AB

The move is aligned with the statutory limit on the number of tax audits that can be undertaken by a chartered accountant in practice. By integrating the ceiling directly into the UDIN generation system, ICAI aims to ensure automated compliance and prevent excess reporting beyond the permissible threshold.

Field-Level Validation Already Operational

In addition to the upcoming cap, the UDIN Directorate clarified that field-level validation has already been implemented at the time of UDIN generation. This validation mechanism applies across all sub-categories under Section 44AB [clauses (a) to (e)] within the ‘GST and Tax Audit’ category.

The Directorate emphasized that this configuration will continue to remain applicable even after the enforcement of the audit ceiling from April 1, 2026. The validation system is designed to enhance accuracy, maintain data integrity, and ensure that audit reports correspond precisely with the relevant statutory provisions.

Strengthening Compliance Architecture

The dual measures—field-level validation and the 60-audit ceiling—reflect ICAI’s continued efforts to strengthen professional accountability and uphold audit quality standards. By embedding compliance checks at the stage of UDIN generation, the system reduces the risk of procedural lapses and reinforces regulatory discipline among practitioners.

Members have been requested to take note of the changes and align their tax audit planning and UDIN generation practices accordingly.

For clarifications, members may contact the UDIN Directorate via the official communication channel provided by ICAI.

With these changes, ICAI is signaling a more technology-driven and compliance-focused approach to tax audit regulation, ensuring adherence to statutory limits while promoting transparency and professional standards in the audit ecosystem.

Read More: AO Can’t Deny S. 244A Refund Interest Without Commissioner’s Decision: Delhi High Court