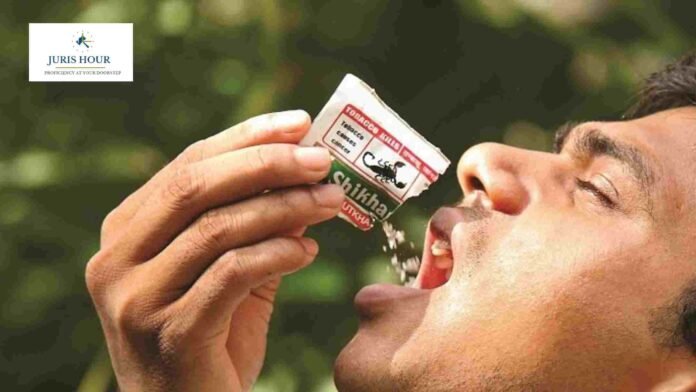

The Central Government has issued Notification No. 01/2026–Central Excise, granting a partial exemption from National Calamity Contingent Duty (NCCD) on specified chewing tobacco products. The exemption has been notified by the Ministry of Finance, Department of Revenue, and will come into force from May 1, 2026.

The exemption applies to Chewing tobacco falling under tariff item 2403 99 10; Jarda scented tobacco under tariff item 2403 99 30 and all other goods classified under tariff item 2403 99 90. The effective rate of NCCD has been capped at 25%.

The notification has been issued in exercise of powers conferred under Section 5A(1) of the Central Excise Act, 1944, read with Section 136 of the Finance Act, 2001. The government stated that the exemption is being granted in the public interest, a phrase frequently used to justify fiscal relief measures or rationalisation of indirect taxes.

Under the Finance Act, 2001, NCCD is levied on certain goods to fund relief and rehabilitation measures during national calamities. Tobacco and tobacco products have historically attracted higher NCCD rates, reflecting both revenue considerations and public health concerns.

As per the notification, excisable goods falling under Chapter 24 of the Fourth Schedule to the Central Excise Act, specifically chewing tobacco and allied products, will be exempted from so much of the NCCD as is in excess of 25%, subject to classification under specified tariff items.

The notification clearly specifies that the exemption shall take effect from May 1, 2026, providing manufacturers and stakeholders with a lead time to adjust pricing, compliance, and duty calculations.

Notification Details

Notification No. 01/2026-Central Excise

Date: 01/02/2026