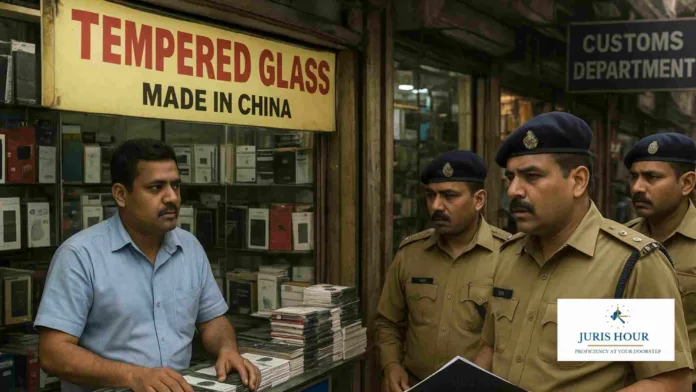

The Delhi High Court has declined to interfere with an order of the Customs Department regarding the provisional release of nearly 5 lakh units of mobile tempered glass seized earlier this year from a premises in Karol Bagh. The seized goods, valued at over ₹56 lakh, bore “Made in China” labels, raising suspicions of illegal importation.

A Division Bench comprising Justice Prathiba M. Singh and Justice Shail Jain noted that the petitioner’s claim of domestic procurement was inconsistent with the affixed foreign labels. The Court remarked that such misrepresentation misleads consumers and undermines government policies aimed at promoting indigenous manufacturing under the Made in India campaign.

The case arose from a raid conducted by the Customs Department on February 20, 2025, at a girls’ paying guest accommodation in Karol Bagh. During the search, several cartons of tempered glass were recovered, leading to the seizure of the goods on the grounds that they were allegedly imported illegally from China.

The petitioner, Sonaram Bagadaram Mali, argued that the goods were locally manufactured and procured from Indian markets. His counsel maintained that no foreign purchase order was placed and no customs agents were engaged. He admitted that the goods carried “Made in China” and other foreign labels but insisted that this was done solely for competitive pricing and market appeal.

Challenging the Customs Department’s conditions for provisional release, the petitioner contended that the imposed requirement of a bond of ₹56,03,995 along with a bank guarantee of ₹29,75,189 was financially burdensome and unjustified since no customs duty was applicable.

The court held that verifying the origin of the goods would require a factual investigation, which was outside the scope of a writ petition. Consequently, the Court upheld the Customs Department’s order dated June 10, 2025, allowing only provisional release subject to conditions.

The High Court clarified that the petitioner is free to join the ongoing investigation. He may pursue an appeal under Section 128 of the Customs Act, 1962; and Customs may initiate proceedings against other suppliers allegedly involved in the chain of procurement.

Case Details

Case Title: Sonaram Bagadaram Mali Versus The Commissioner Of Custom & Ors.

Case No.: W.P.(C) 13649/2025 & CM APPL. 55986/2025

Date: 4th September, 2025

Counsel For Petitioner: Mr. Omkar Kushwaha

Counsel For Respondent: Mr. Shubham Tyagi

Read More: Delhi High Court Directs Appeal in Alleged Rs. 1.34 Crore Duty Drawback Fraud Case